Article by: Asst.Prof. Suwan Juntiwasarakij, Ph.D., MEGA Tech Senior Editor

รูปแบบการขนส่งสินค้าภายในวันเดียวที่ริเริ่มโดย Amazon ดูเหมือนจะกลายเป็นทำเนียมปฏิบัติใหม่ที่ส่งผลต่อความคาดหวังของผู้บริโภคว่าควรจะได้รับสินค้าและบริการอย่างไร ในการจัดส่งสินค้ากว่า 10 ล้านชิ้นด้วยความรวดเร็วนั้น ในแต่ละปี Amazon ใช้เม็ดเงินกว่าหมื่นล้านดอลลาร์และจ้างงานเพิ่มกว่า 250,000 ตำแหน่งเพื่อประจำคลังสินค้าเฉพาะในประเทศสหรัฐอเมริกา อีกทั้ง เสริมขีดกำลังความสามารถการขนส่งสินค้าด้วยเครื่องบินลำเลียงสินค้าของตัวเองอีกกว่า 50 ลำ รถยนต์กึ่งบรรทุก 300 คัน และรถตู้สำหรับการขนส่งระยะสุดท้ายอีก 20,000 คัน ทั้งหมดนี้ทำงานได้อย่างไม่ติดขัดโดยอาศัยกระบวนการทำงานที่ยากและท้าทายอย่างไม่น่าเชื่อ

A NEW SHIPPING NORMAL PARADIGM

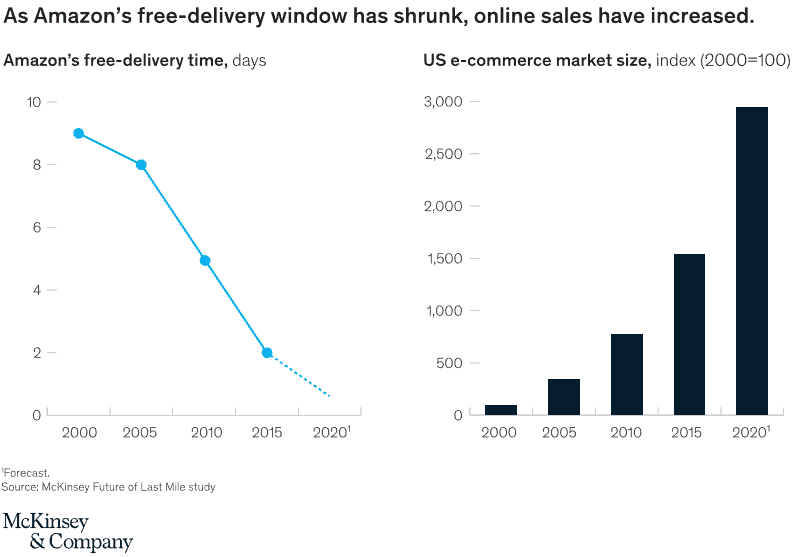

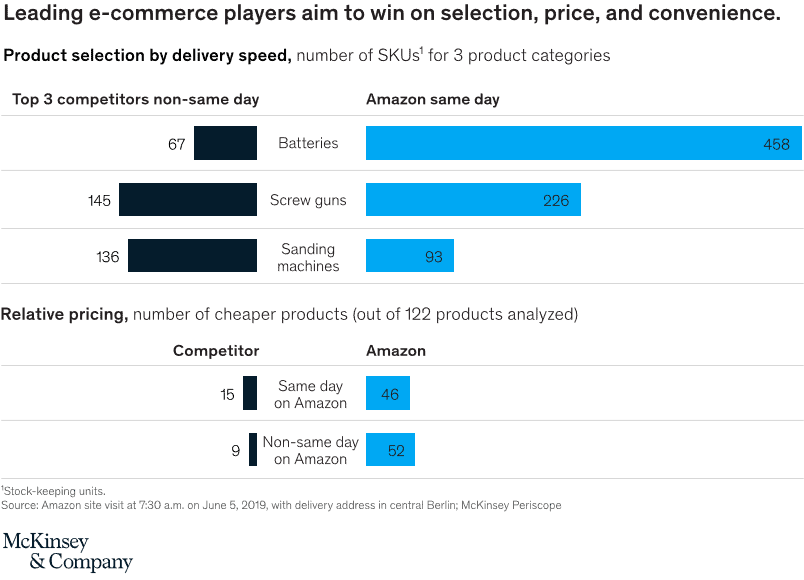

มาตรฐานการส่งสินค้าถูกทำลายและสร้างขึ้นใหม่โดยบริษัทเช่นAmazon รวมทั้งคู่แข่งทรงอิทธิพลอีกหลายรายในตลาดเหล่านี้ ได้สร้างแรงกดดันอันหนักหน่วงให้แก่ผู้เล่นหน้าเก่าที่จะปรับตัวให้เท่าทันการเปลี่ยนแปลงนี้ ในขณะที่เวลาที่ใช้ในการส่งสินค้าแบบไม่คิดค่าใช้จ่ายของAmazon สั้นลง ยอดขายออนไลน์นั้นกลับเพิ่มขึ้นเรื่อยๆ

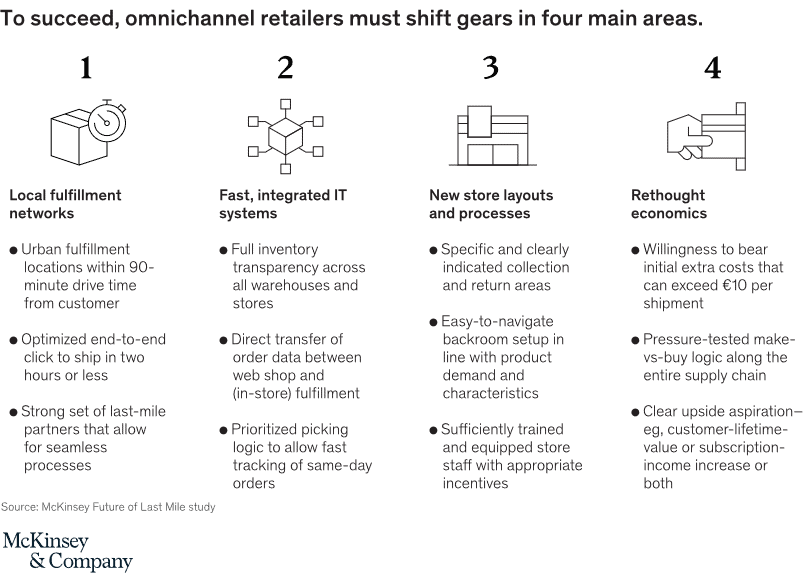

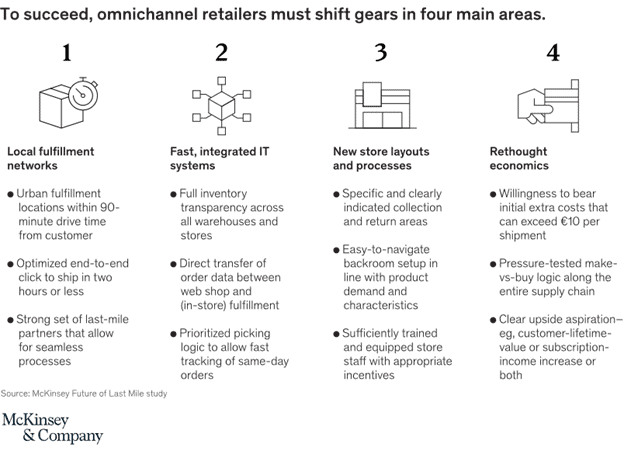

จากบทวิเคราะห์ของแมคคินซีย์แอนด์คอมปะนี แรงกดดันที่มีต่อผู้เล่นความสามารถในการปรับตัวช้าอาจจะมากเกินกว่าจะรับมือได้ ธุรกิจค้าปลีกควรจะต้องมีสินทรัพย์เชิงกลยุทธ์ที่สามารถนำมาใช้ให้เกิดประโยชน์และความได้เปรียบได้ในอนาคต เช่น เครือข่ายร้านอันหนาแน่นที่จะสร้างความได้เปรียบในการเข้าถึงผู้บริโภคได้อย่างรวดเร็วว่องไว เพื่อที่ได้รับประโยชน์อย่างเต็มที่จากเครือข่ายร้านเหล่านี่ ธุรกิจค้าปลีกแบบหลากหลายช่องทางจำเป็นจะต้องทบทวนเปลี่ยนแปลงทั้ง 4 ประการ อันได้แก่ ระบบเครือข่ายคลังสินค้าท้องถิ่น ระบบเทคโนโลยีสารสนเทศที่ทั้งรวดเร็วและเชื่อมต่อบูรณาการ การวางผังร้านใหม่และการออกแบบกระบวนการภายในร้าน และเปลี่ยนวิธีคิดที่เป็นเศรษฐศาสตร์ทางธุรกิจ

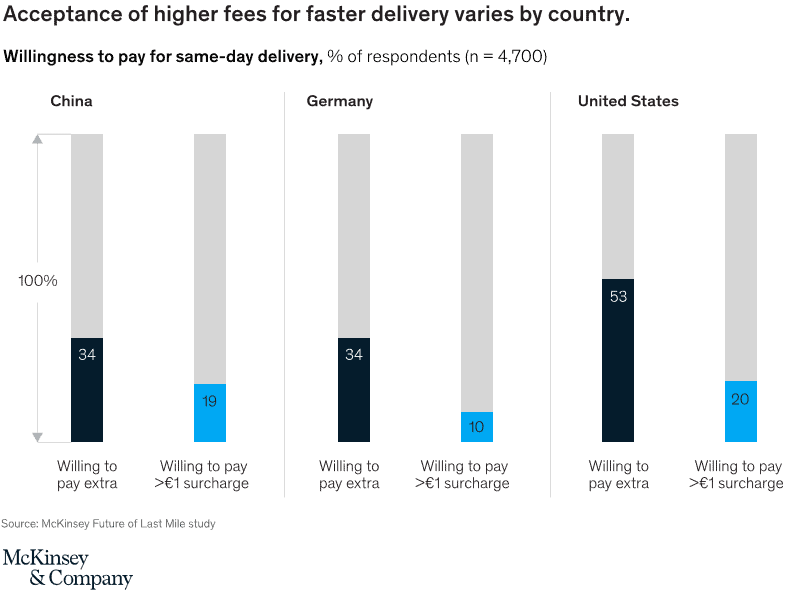

ในขณะที่การขายออนไลน์พุ่งทะยาน เวลาที่ใช้ในการส่งสินค้ากลับสั้นลง ย้อนไปเมื่อสองทศวรรษที่ผ่านมาเราแทบจะไม่มีเรื่องราวความสำเร็จทางธุรกิจเหมือนอีคอมเมิร์ซ แต่มาในวันนี้ผู้บริโภคคาดหวังว่าจะได้รับสินค้าภายใน 2 วันนับจากวันที่สั่งซื้อ และการตัดสินใจที่จะซื้อหรือไม่ซื้อนั้นขึ้นผูกอยู่กับเวลาที่ใช้ส่งสินค้ามากขึ้นเรื่อยๆ ผู้บริโภคทั่วไปในตลาดมีความคาดหวังสูง อย่างเช่นในสหรัฐอเมริกาผู้บริโภคมากกว่าครึ่งต่างสนใจบริการส่งสินค้าภายในวันเดียวแม้ว่าจะมีข้อจำกัดด้านรายจ่ายการขนส่งสินค้าก็ตาม

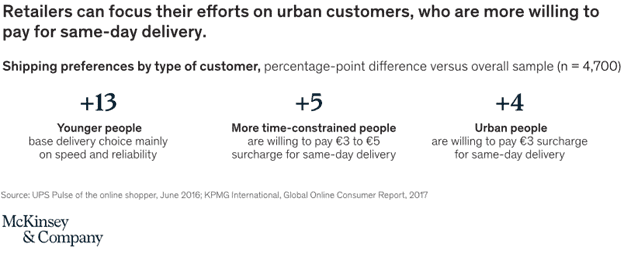

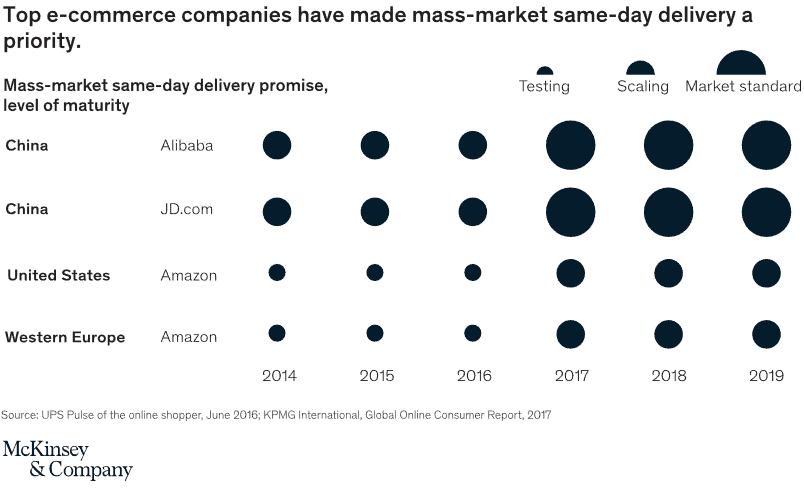

ผู้บริโภคหนุ่มสาวในชุมชนซึ่งมีข้อจำกัดด้านเวลา คือ ผู้บริโภคในกลุ่มการจัดส่งสินค้าภายในวันเดียว เพื่อที่จะรักษาลูกค้ากลุ่มนี้ไว้ผู้เล่นรายใหญ่เช่นAmazon Alibaba และ JD ต่างก็ผลักดันการส่งสินค้าภายในวันเดียวไปยังตลาดระดับแมส รูปแบบการขนส่งดังที่กล่าวนี้ที่กำลังจะกลายเป็นปัจจัยรากฐานเพื่อที่จะครองใจผู้บริโภคนอกเหนือจากความหลากหลาย ราคา และความสะดวก

TOWARDS FOUR AREAS FOR SHIFTING GEARS

ธุรกิจค้าปลีกแนวคิดออมนิชาแนลที่ตัดสินใจดำเนินรอยตามกลยุทธ์นี้ ลำพังการยกเครื่องระบบงานคลังสินค้าอย่างเดียวคงไม่พอ แต่จำเป็นต้องรวมถึงการออกแบบร้านและระบบสารสนเทศ เพื่อเปิดใจรับชุดความคิดใหม่และแตกต่าง เพื่อทำความเข้าใจเศรษฐศาสตร์ของการดำเนินธุรกิจ

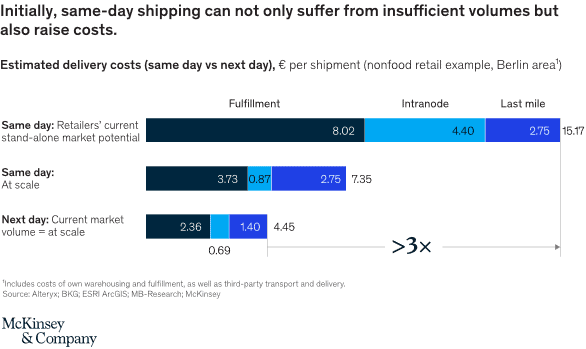

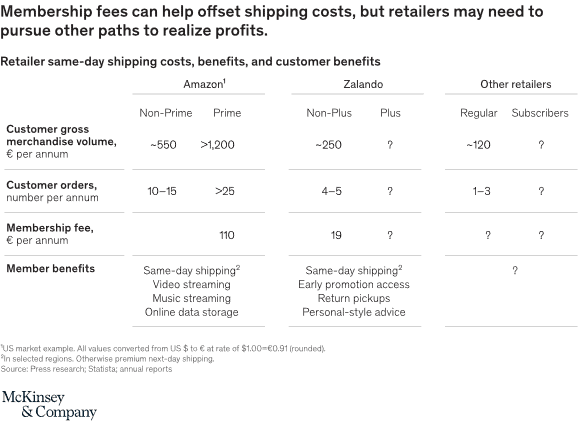

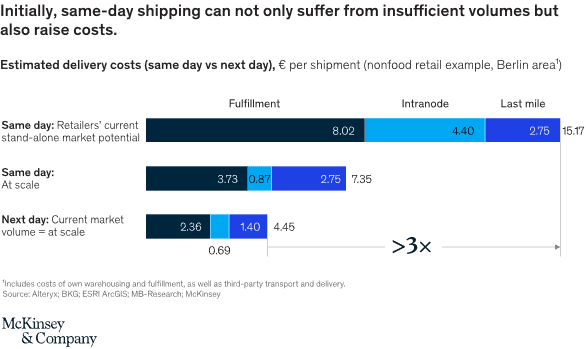

จะเห็นว่าการลงเล่นในสนามแข่งการส่งสินค้า “ภายในวันเดียว” ว่าเป็นเรื่องยากก็ไม่ผิด ในระยะแรกนั้นธุรกิจค้าปลีกจะประสบปัญหาปริมาณสินค้าที่ขายออกไปยังไม่ทำให้เกิดภาวะคุ้มทุน ส่วนค่าใช้จ่ายเกี่ยวกับการขนส่งสินค้านั้นจะสูงกว่ารูปแบบการส่งสินค้าแบบ “ได้รับในวันถัดไป” ซึ่งเป็นมาตรฐานของธุรกิจค้าปลีกในขณะนี้ รูปแบบธุรกิจแบบสมัครสมาชิกจะสามารถบรรเทาต้นทุนในส่วนนี้ได้ หากแต่ต้องอาศัยความเข้าใจในรูปแบบการบริโภคเฉพาะตัวของลูกค้า เพื่อที่จะจัดสรรค์การส่งสินค้าแบบสมัครสมาชิกที่เป็นที่ต้องการและเป็นประโยชน์แก่ลูกค้า เป็นหน้าที่ของค้าปลีกที่จะต้องคิดค้นเทคนิคกลเม็ดเพื่อต่อยอดสร้างกำไรจากรูปแบบการส่งสินค้าภายในวันเดียวที่ได้นำเสนอให้แก่ผู้บริโภค