Article by: Asst. Prof. Suwan Juntiwasarakij, Ph.D., MEGA Tech Senior Editor

โซลูชั่นของบรรจุภัณฑ์อัจฉริยะ (Smart Packaging) เสียส่วนใหญ่มาจากการใช้เคมีภัณฑ์และวัสดุอันล้ำหน้าเพื่อการควบคุมการสึกกร่อนหรือความชื่น หรือสารที่มีคุณสมบัติพิเศษเปลี่ยนสีได้เมื่ออุณหภูมิของสารเปลี่ยนที่พบได้ในอุตสาหกรรมผลิตภัณฑ์อาหารและเครื่องดื่ม ผลิตภัณฑ์ทางการแพทย์ และสินค้าอุปโภคบริโภคที่เกี่ยวกับสุขอนามัยทั่วไป ยังมีโอกาสที่ยังไม่มีใครเข้าถึงอยู่อีกมากสำหรับบรรจุภัณฑ์ที่มีความสามารถในการเชื่อมต่อสื่อสารระหว่างบรรจุภัณฑ์ด้วยกันเองหรือระหว่างบรรจุภัณฑ์กับเครือข่ายอินเตอร์เน็ตด้วยระบบบาร์โค้ดง่ายกับอุปกรณ์ชิ้นส่วน RFIDs ถูกนำมาใช้เพิ่มขึ้นเรื่อยในงานตรวจสอบสถานภาพและงานติดตามตำแหน่งของสินค้าในห่วงโซ่อุปทาน

Source: Mordor Intelligence

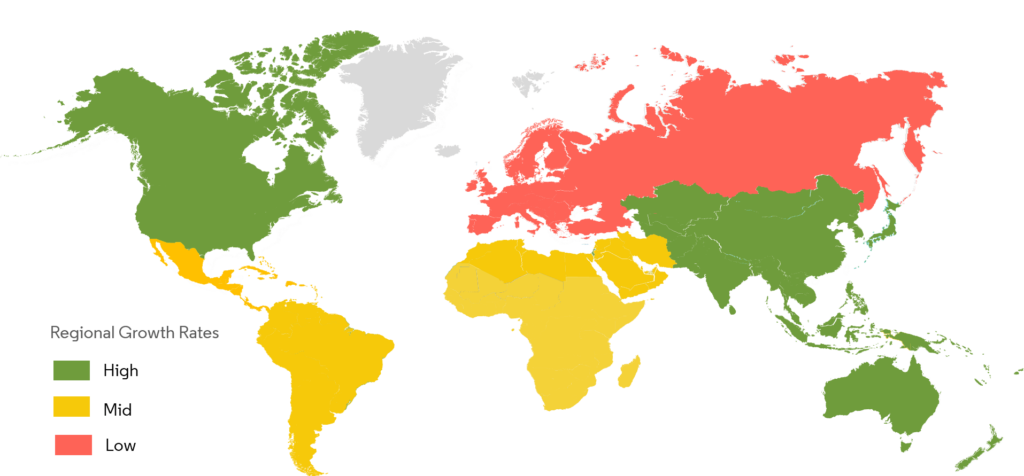

สำหรับตลาดของบรรจุภัณฑ์อัจฉริยะนั้นสามารถจำแนกออกเป็นส่วนการตลาดย่อยโดยใช้ปัจจัยทางเทคโนโลยี (active packaging, intelligence packaging) ลักษณะการใช้งาน ณ ปลายทางของการบริโภค (food, beverage, healthcare, personal care) และ สภาพทางภูมิศาสตร์ตามรายงานของ Mordor Intelligence พบว่ามูลค่าของตลาดอยู่ที่ 35.33 พันล้านดอลลาร์ ในปี 2018 และคาดการณ์ว่ามูลค่าจะอยู่ที่ 44.39 พันล้านดอลลาร์ภายในปี 2024 ด้วย CAGR ที่ร้อยละ 4.19 สำหรับช่วงการพยากรณ์ระหว่างปี 2019-2029 บรรจุภัณฑ์อัจฉริยะนี้ช่วยให้การสื่อสารและการตรวจสอบคุณภาพอาหารโดยโดยใช้อุปกรณ์ชี้วัดเวลาและอุณหภูมิ

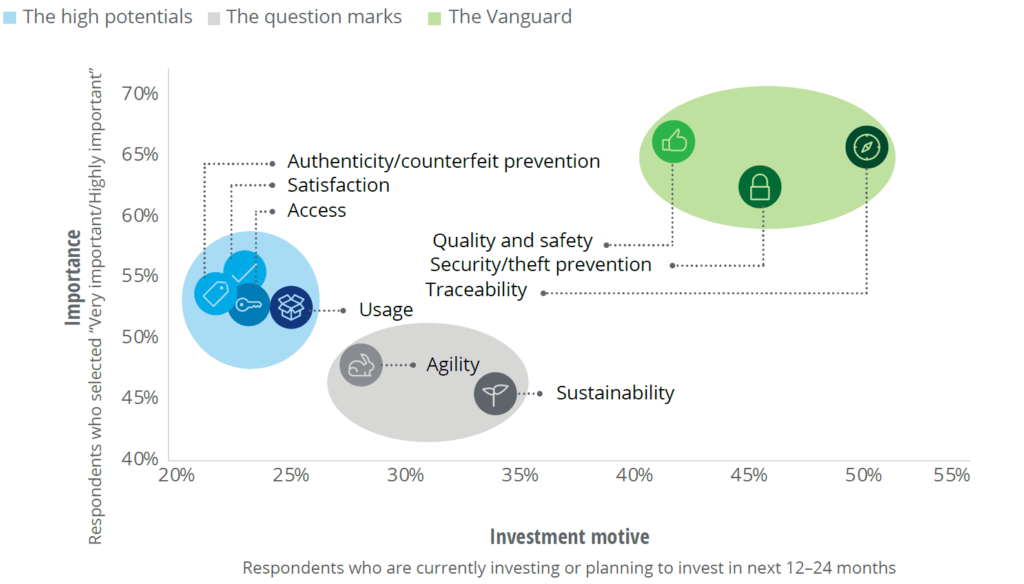

Source: Deloitte Analysis

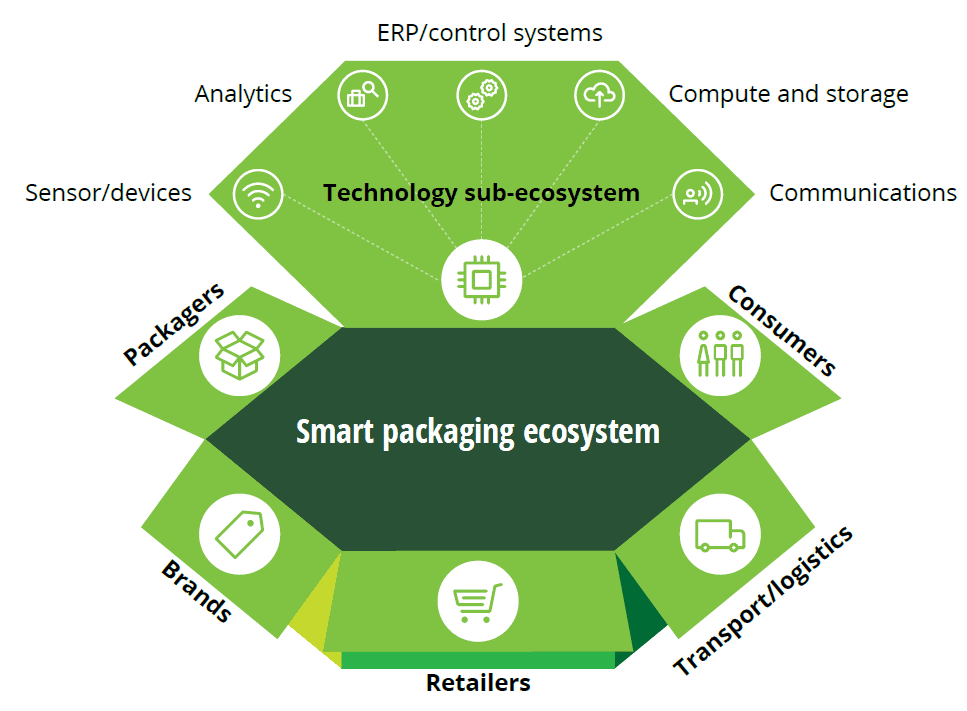

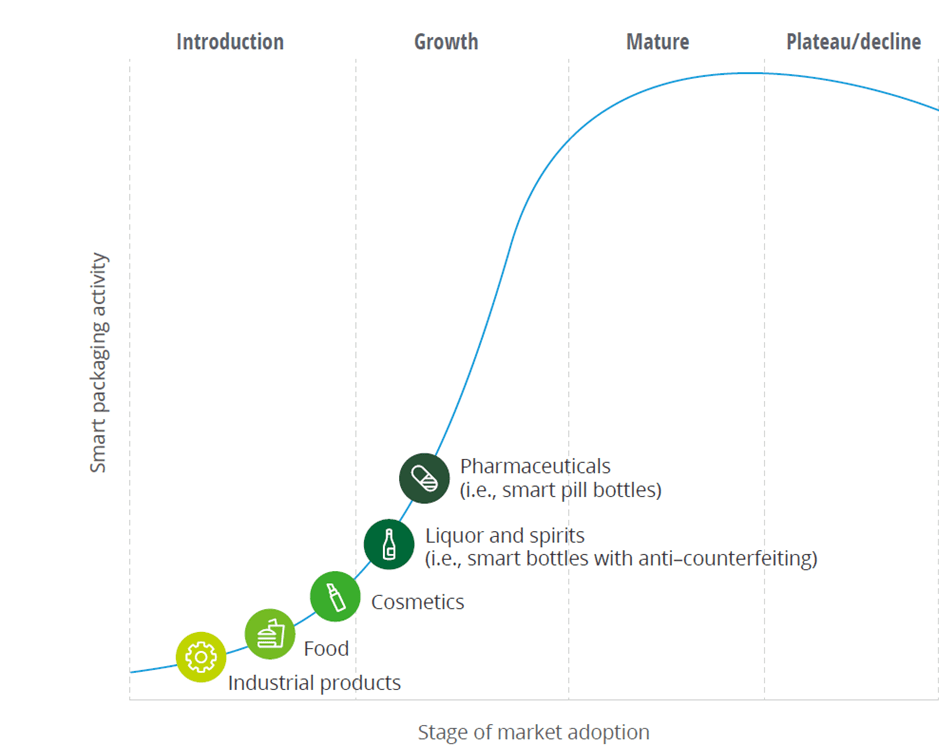

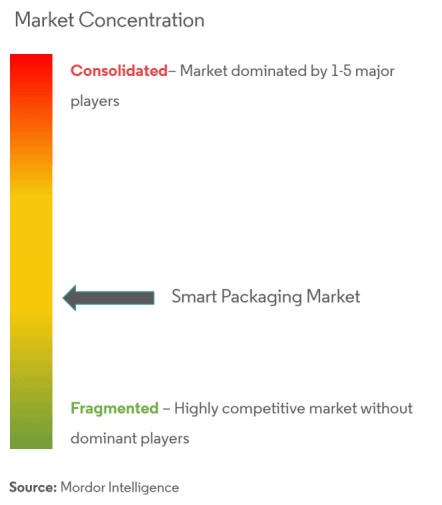

ผลการสำรวจของ Deloitte พบว่ามีการประยุกต์ใช้เทคโนโลยีบรรจุภัณฑ์อัจฉริยะในหลากหลายอุตสาหกรรม โดยเฉพาะบริษัทในกลุ่มอุตสาหกรรมการผลิตต่างแสดงความสนใจต่อบรรจุภัณฑ์อัจฉริยะมากเป็นพิเศษ อย่างไรก็ดี บรรจุภัณฑ์อัจฉริยะนี้ยังนับว่าอยู่ในระยะต้นของภาวะการเติบโตเท่านั้น ยังไม่มีสัญญาณบ่งบอกใดๆ ว่าจะถึงจุดอิ่มตัวในเวลากันใกล้ อุตสาหกรรม Smart Packing มีลักษณะการจายตัวมาก มีลักษณะทางธุรกรรมเป็นทั้งแบบธุรกิจขนาดใหญ่กับขนาดกลาง และแบบธุรกิจขนาดเล็กกับขนาดกลาง ซึ่งต่างก็สนใจเพียงแค่สร้างโซลูชันที่มีความเจาะจงเพื่อตอบสนองความต้องการของลูกค้าเฉพาะราย ซึ่งวิธีการเช่นนี้ขัดแย้งกับแนวทางเชิงบูรณาการเพื่อก่อให้เกิดการขยายผลในระดับสเกล อย่างไรก็ดี ด้วยธรรมชาติของอุตสาหกรรมนี้ จะพบว่ามีผู้ที่มีส่วนเกี่ยวข้องเป็นจำนวนมากที่อยู่ในระบบนิเวศน์เดียวกัน นับตั้งแต่ผู้ที่กำหนดโครงสร้างพื้นฐานม ไปจนถึงผู้บรรจุภัณฑ์ ผู้สร้างแบรนด์ ผู้ค้าปลีก และกระทั่งลูกค้าผู้บริโภค จึงทำให้อัตราการเติบโตเป็นไปได้ช้า

ผู้ผลิตและผู้ใช้บรรจุภัณฑ์อัจฉริยะล้วนแล้วแต่เป็นผู้รับผลประโยชน์จากเทคโนโลยีดังกล่าวกันถ้วนหน้า ผู้ผลิตในที่นี้รวมถึงผู้บรรจุภัณฑ์ ผู้ผสมเนื้อวัสดุ ผู้ให้บริการด้านเทคโนโลยี โดยที่อนิสงค์นั้นเกิดขึ้นตั้งแต่ในกระบวนการออกแบบ การผลิตตัวบรรจุภัณฑ์ และไปจนกระทั่งการเป็นส่วนหนึ่งของโซลูชันที่นำเสนอให้แก่ลูกค้า หลายผู้ประกอบการได้อนิสงค์ทันตาเห็นเพียงแค่ได้เกริ่นผลที่จะเกิดจากการนำแนวคิด Smart Packaging มาใช้งานโดยที่ไม่ได้กล่าวถึงความเป็นไปได้ในเชิงพาณิชย์ ก็ทำให้ยอดการขายใน Production Line เดิมของตัวเองสูงขึ้นแทบจะทันที อย่างไรก็ดี ปรากฎการณ์ดังกล่าวนี้เรียกว่า “Halo Effect”

Source: Mordor Intelligence

ที่มากไปกว่านั้นก็คือส่วนมากแล้วผู้ที่พลักดันให้เกิดนวัตกรรมในอุตสาหกรรมนี้คือบริษัท Start-up ขนาดจิ๋ว แต่ก็เป็นที่น่าเสียดายว่าบริษัทเหล่านี้ยังไม่สามารถสร้างผลกระทบให้แก่ตลาดได้มากเท่าที่ควร และแม้ว่ามาตรฐาน IoT ได้ถือกำเนิดขึ้นมาและเป็นที่ยอมรับกันสักพักหนึ่งแล้วก็ตาม สภาพความเป็นจริงนั้นก็ไม่ต่างไปจากเทคโนโลยีก่อนหน้าอย่างเช่น Bluetooth หรือ WiFi ที่นำมาใช้ในเครือข่าย LAN ในวงแคบ ส่วนต้นทุนของระบบเซ็นเซอร์เต็มรูปแบบและระบบการเชื่อมต่อสื่อสารยังมีราคาสูงถึงแม้ว่าจะมีการคาดการณ์ว่าราคาของอุปกรณ์ดังกล่าวนี้จะต่ำลงอย่างมากในอนาคตอันใกล้ก็ตาม

Source: Deloitte Analysis

ใครก็ตามที่คิดจะมาลงเล่นในสนาม Smart Packaging แห่งนี้ นอกจากจะต้องวางทีท่าสำรวมเป็นมิตรต่อพันธมิตรคู่ค้าในตลาดแล้ว ยังจะต้องดิ้นรนหาหนทางสร้างนวัตกรรมให้เกิดแก่ธุรกิจตัวเองอีกแรงหนึ่งด้วย ไม่ง่ายเลยที่จะคงความสามารถในการคิดริเริ่มสร้างสรรค์ด้วยการรัดเข็มขัดประหยัดต้นทุนที่หมุนเวียนอยู่ในกระบวนการทางธุรกิจต่างๆ แม้ว่าจะเต็มไปด้วยการแข่งขันอันดุเดือดก็ตามวงล้อนวัตกรรมของ Smart Packaging ก็จะยังคงหมุนต่อไป ก่อเกิดเทคนิคต่อยอดความคิดสู่นวัตกรรมการพัฒนาผลิตภัณฑ์ บริหารทรัพยากรมนุษย์ทีมงานได้รวดเร็ว สร้างต้นแบบได้ทันท่วงที ทดสอบในตลาดจริง ประเมินผลจากความจริงที่เกิดขึ้นตรงหน้า และทำซ้ำวนๆ ไป