Article by: Suwan Juntiwasarakij, Ph.D., MEGA Tech Senior Editor

ปัญญาประดิษฐ์ได้กลายมาเป็นคำสามัญประจำบ้าน ก็เพราะว่าเทคโนโลยีนี้ได้หล่อหลอมเข้ากับชีวิตส่วนตัวและชีวิตการทำงานของเราได้อย่างลงตัว จนกระทั่งหลายคนลืมไปว่าสินค้าและบริการที่บริโภคอยู่นั้นล้วนประกอบด้วยเทคโนโลยีปัญญาประดิษฐ์ทั้งสิ้น ปัญญาประดิษฐ์ฝังตัวอยู่ในเครื่องใช้ไฟฟ้าภายในบ้าน ร้านค้าขายปลีกทั้งออนไลน์และออฟไลน์ รถยนต์ที่สามารถขับเคลื่อนได้ด้วยตัวเอง และกระบวนการผลิตแบบอัจฉริยะ ถึงกระนั้นก็ตามโลจิสติกส์ในปัจจุบันยังถือได้ว่าเป็นเพียงจุดเริ่มต้นของการเดินทางอันเต็มไปด้วยความท้าทายอยู่เบื้องหน้าซึ่งกำลังจะมาถึง

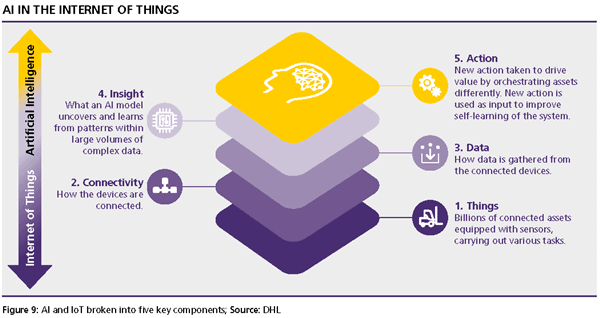

ถึงแม้ว่า AI จะมีขีดความสามารถมากก็ตาม เทคโนโลยี AI นี้ประกอบขึ้นจากเทคโนโลยีอื่นๆ ที่เกี่ยวข้อง ซึ่งส่วนผสมของเทคโนโลยีที่ประกอบขึ้นเป็น AI นี้จะแปรผันไปตามปัญหาที่ก่อนจะได้รับการแก้ไข ผลการวิเคราะห์วิจัยจากดีเอสแอลไอบีเอ็มที่กล่าวว่าเทคโนโลยี AI ประกอบด้วยสามองค์ประกอบหลักด้วยกัน ได้แก่ การรับรู้ข้อมูล การประมวลผลข้อมูลและการเรียนรู้จากข้อมูล

การรับรู้ข้อมูล หมายถึง ความสามารถในการเข้าใจข้อมูลจากลูกค้าตามความเป็นจริงเหมือนกับที่มนุษย์เข้าใจข้อมูลต่างๆ ไม่ว่าจะเป็นรูปภาพ วิดีโอ หรือไม่ก็เสียง รวมทั้ง สภาวะสิ่งแวดล้อมต่างๆ รอบตัว ด้วยเหตุนี้ไอโอทีจึงกลายเป็นแหล่งสร้างข้อมูลสำคัญให้กับระบบ AI ส่วน

การประมวลผลและการเรียนรู้นั้นหมายถึง งานและการฝึกฝนไห้ AI สามารถเรียนรู้ได้ซึ่งเทคนิคการเรียนรู้นั้น เช่น การเรียนรู้แบบมีการควบคุมดูแล แนะนำ การเรียนรู้แบบไม่ต้องการคำแนะนำและการบังคับเรียนรู้ ปัจจุบันมีระบบงาน Machine Learning อยู่จำนวนหนึ่งแต่ มีแก่นเดียวกันคือ Neural Network หรือโครงข่ายใยประสาทปัจจุบัน AI และเทคโนโลยีเกี่ยวข้องอื่นๆนั้นในการจะฝังตัวอยู่ในเทคโนโลยีแบบอิสระในกระบวนการต่างๆ

TECHNOLOGICALLY UNIFIED LOGISTICS SCENARIOS

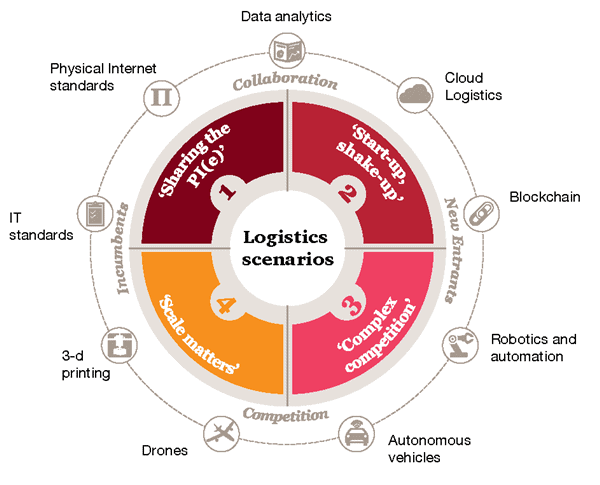

ในทุกวินาทีอุตสาหกรรมล้วนเผชิญกับเทคโนโลยีที่มีความสามารถในระดับเปลี่ยนทิศทางของโลกอุตสาหกรรมได้ตลอดเวลา ผู้ให้บริการที่สามารถคิดส่วนผสมทางเทคโนโลยีให้เข้ากับกลไกลทางธุรกิจของตนเองให้ได้ จึงจะสามารถใช้ประโยชน์ได้อย่างเต็มที่ และที่จะกลายเป็นโมเดลธุรกิจที่ตอบสนองทุกกระบวนการของบริษัทของตนได้อย่างทั่วถึง PwC แบ่งสถานการณ์ในตลาดออกเป็น 4 รูปแบบ ซึ่งเทคโนโลยีจะมีบทบาทที่สำคัญแต่กลับสร้างความเปลี่ยนแปลงให้กับตลาดที่แตกต่างกันออกไป และ 2 ใน 4 โมเดลนี้จะมีผู้เล่นหน้าใหม่เป็นแรงขับเคลื่อนหลักในขณะที่ผู้เล่นเจ้าถิ่นจะยังคงไว้ซึ่งอิทธิพลใน 2 โมเดลที่แหลือ ธรรมชาติของกลไกตลาดทั้งที่ร่วมมือและแข่งขันจะจำแนกแบ่งรูปแบบทั้ง 4 ออกจากกัน รูปแบบที่กล่าวถึงได้แก่ Sharing the Physical Internet, Start-up and Shake-up, Complex Competition, และ Scale Matters

Sharing the Physical Internet หมายถึงการที่ผู้เล่นรายใหญ่หน้าเก่าเพิ่มประสิทธิภาพของตนและลดแรงปะทะจากภายนอกด้วยการร่วมมือกับพันธมิตรเพื่อพัฒนาโมเดลธุรกิจใหม่ๆ เช่น การแบ่งเครือข่าย การค้นคว้าวิจัยด้านนี้จะนำไปสู่การกำหนดมาตรฐานร่วมกันเพื่อขยายขีดจำกัดทางโลจิสติกส์ ด้านขนาดและปริมาณ เสริมความแข็งแกร่งของเครือข่าย รวมทั้งความต้องการด้านไอทีในเครือข่าย ส่วน Start-up and Shake-up นั้นจะเกิดขึ้นเมื่อผู้เล่นหน้าใหม่กลายเป็นผู้เล่นคนสำคัญซึ่งจะเข้ามีส่วนแบ่งการตลาดไปจากผู้เล่นรายใหญ่เจ้าถิ่นโดยอาศัยโมเดลธุรกิจใหม่ๆ ที่มีอาศัยเทคนิค Data Analytics Blockchain และเทคโนโลยีต่างๆ ที่ยังไม่ได้กล่าวถึงอีกเป็นจำนวนหนึ่ง จะมีเพียงผู้เล่นจำนวนหนึ่งหรือไม่ก็สองรายเท่านั้นที่จะมีอิทธิพลครอบงำ Segment นั้น และการขนส่งแบบ Last-Mile จะเป็นสีสันของตลาดด้วยความหลากหลายและแตกต่างจากโมเดลเดิมๆ ในอดีต Crowd-Delivery ที่ได้รับความนิยมเพิ่มขึ้นเรื่อยๆ สุดท้ายแล้ว Start-up จะร่วมมือกับผู้เล่นรายเก่าเพื่อเติมเต็มช่องว่างในสินค้าและบริการของตน

Complex Competition คือสถานการณ์ที่ผู้เล่นรายใหญ่แผ่ขยายการให้บริการให้ทั่วถึงและกว้างขวางขึ้น จากเดิมให้บริการเพียงลูกค้ากลายเป็นให้บริการคู่แข่งด้วย โดยที่ผู้เล่นรายใหญ่เหล่านี้จะเหมาซื้อผู้เล่นรายเล็กหลายๆ เพื่อความสามารถในการคุมโต๊ะครอบคลุมตลาด นอกจากนี้แล้วผู้เล่นรายใหญ่จำเป็นต้องทำความเข้าใจพฤติกรรมของผู้บริโภคอย่างลึกซึ้งเพื่อมาปรับปรุงห่วงโซ่อุปทานของตน ส่วนบริษัทเทคโนโลยีที่เดิมเคยเป็นซัพพลายเออร์ก็จะเข้าเล่นในตลาดจนผันตัวเองมาเป็นคู่แข่งเสียเอง Scale Matters คือสถานการณ์ที่ผู้เล่นรายเก่าเพิ่มประสิทธิภาพด้วยการ Streamlining ระบบงานของตัวเองโดยใช้เทคโนโลยีอย่างเต็ม ผู้เล่นรายเก่าเหล่านี้จะแบ่งสรรเม็ดเงินลงทุนให้กับเทคโนโลยีใหม่ๆ ที่มีอานาคตพร้อมทั้งดึงตัวบุคลากรที่ทักษะที่เป็นที่ต้องการของตลาดเพื่อความสร้างความได้เปรียบในตลาด ผู้เล่นรายสำคัญยังจะรวมตัวกันเองเพื่อที่จะปกคลุมให้ไกลกว่าเดิมข้ามสายการให้บริการในระหว่างผู้เล่นรายใหญ่ ท้ายที่สุดแล้วการเข้าถึงแหล่งเงินนั้นมีความสำคัญอย่างยิ่ง

เพื่อความอยู่รอดในเกมการแข่งขัน ผู้ให้บริการจำเป็นจะต้องเพาะบ่ม “Unique Value Proposition” ด้วยการยึดมั่นต่อตัวตนอัตลักษณ์จากนั้นสร้าง Roadmap ของ กลยุทธ์ที่เสริมรับกับอัตลักษณ์ ถึงเวลาแล้วที่ให้บริการจะต้องทำการสำรวจตัวเองว่าตัวเองมีจุดเด่นของตนเข้มแข็งเพียงพอที่ต่อกรกับผู้แข่งขันได้หรือไม่ บริษัทจำเป็นที่ต้องโฟกัสที่ความเหมาะสมทางเทคโนโลยี การจัดการต้นทุนที่มีประสิทธิภาพ ผลผลิตที่เกิดจากเม็ดเงินที่ลงทุน รวมทั้งขีดความสามารถทางด้านนวัตกรรม และหมั่นพัฒนาสิ่งเหล่านี้อย่างต่อเนื่องเพื่อแปลงกลยุทธ์ให้เห็นสิ่งที่จับต้องเห็นผลได้ในชีวิตประจำวัน