Article by: Asst.Prof. Suwan Juntiwasarakij, Ph.D., MEGA Tech Senior Editor

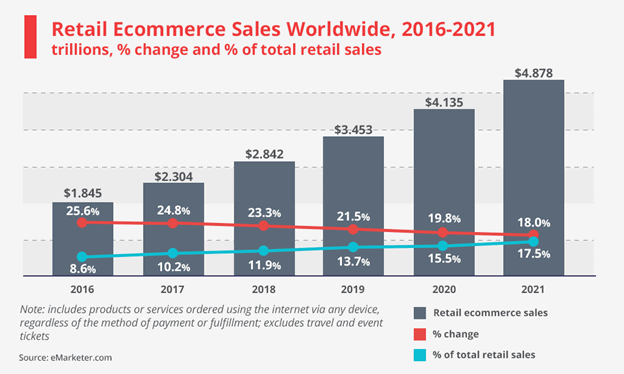

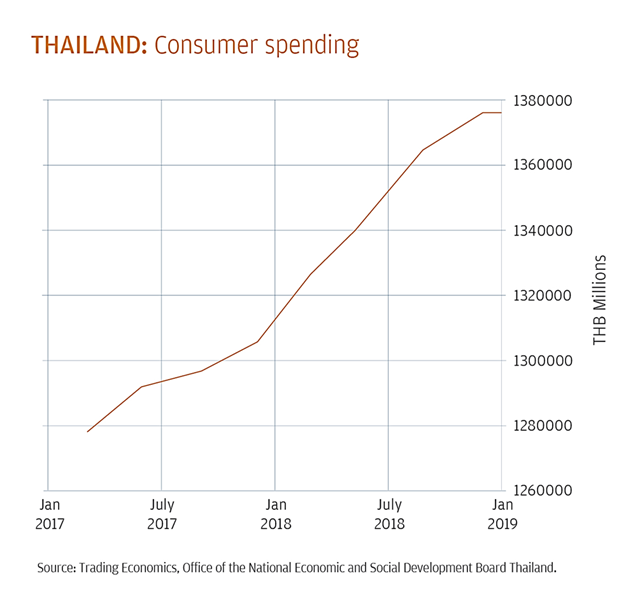

นับตั้งแต่ธุรกรรมซื้อขายที่เรียกว่า e-commerce เกิดขึ้นครั้งแรกเมื่อ วันที่ 12 สิงหาคม 2537 ยอดขายจาก e-commerce ก็ได้เติบโตเรื่อยมาเป็นสัดส่วนที่สำคัญเมื่อเทียบกับยอดการขาย ตลาด e-commerce ของโลกทะลุ 2 ล้านล้านเหรียญสหรัฐไปเรียบร้อยแล้วในปี 2017 โดย Statista คาดว่าจะตัวเลขนี้จะเข้าใกล้ 4 ล้านล้านเหรียญสหรัฐในปี 2021 ตัวอย่างเช่นในประเทศไทยเองตลาดซื้อขายออนไลน์มีมูลค่าถึง 26.2 พันล้านเหรียญสหรัฐ โดยเฉลี่ยแล้วผู้บริโภคในกลุ่มนี้ใช้จ่ายในตลาดถึง 1,747.20 เหรียญสหรัฐต่อปี

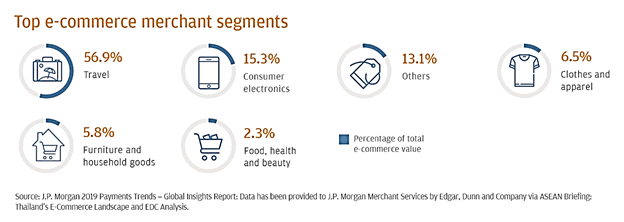

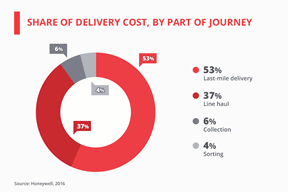

ธุรกิจค้าปลีกทั้งโลกต่างประสบปัญหาการนำส่งสินค้าเพื่อให้ทันและตอบสนองความต้องการของผู้บริโภคที่มากขึ้น “last-mile delivery” คือปัญหาสำคัญเพราะเกิดต้นทุนเป็นสัดส่วนที่สูง ดังนั้นประสิทธิภาพของการบริหารต้นทุน ณ จุด last-mile deliver จึงเป็นความท้าทายเสมอมานับตั้งแต่ e-commerce ได้ถือกำเนิดขึ้น กลับมาที่ประเทศไทย J.P.Morgan พบข้อมูลที่น่าสนใจว่าในภูมิภาคเอเชียตะวันออกเฉียงใต้ นักช็อปชาวไทยคือผู้บริโภคตลาดสินค้าออนไลน์ที่มือเติบที่สุด

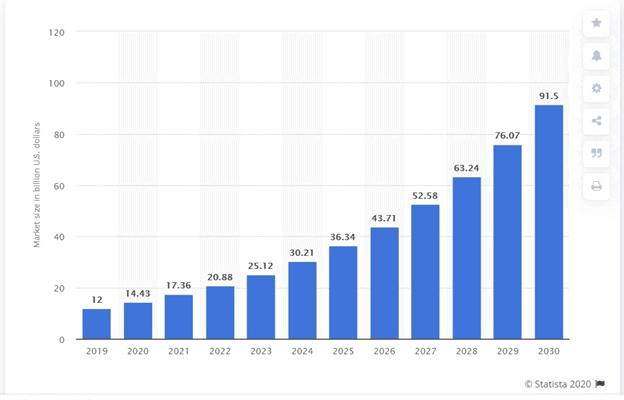

ในตลาด last-mile delivery ระดับโลกมีมูลค่า 1 พันล้านเหรียญสหรัฐในปี 2018 และตัวเลขนี้จะแตะ 7.69 พันล้านเหรียญสหรัฐภายในปี 2027 ด้วย CAGR ที่ 16.7% ด้วยช่วงพยากรณ์จาก 2019 ถึง 2026 สำหรับ segment ในตลาดนี้แบ่งตามการประยุกต์ใช้งาน เช่น กลุ่มเชิงพาณิชย์ กลุ่มอุตสาหกรรม กลุ่มคลังสินค้า และกลุ่มอื่น หากพิจารณาตามลักษณะทางภูมิศาสตร์แล้ว ตลาด last-mile market จะถูกแบ่งเป็นห้ากลุ่มภูมิภาค ได้แก่ กลุ่มอเมริกาเหนือ กลุ่มยุโรป กลุ่มเอเชียแปซิฟิค กลุ่มตะวันออกกลางและแอฟริกา และกลุ่มแอฟริกาใต้

คาดว่าตลาด last-mile delivery ในเอเชียแปซิฟิคจะเติบโตจาก 500 ล้านเหรียญสหรัฐในปี 2018 เป็น 2,292.6 ล้านเหรียญสหรัฐในปี 2027 ด้วย CAGR ที่ 19.0% ในช่วงพยากรณ์จาก 2019 ถึง 2026 การเติบโตของตลาดในภูมิภาคนี้ดูเหมือนจะสอดคล้องกับกลุ่มอุสาหกรรมยานยนตร์ อย่างไรก็ดีตลาด last-mile delivery ก็ยังถือว่าโตช้ากว่าที่ควรจะเป็น อันเนื่องมาจากการขาดแคลนบุคลากรที่มีทักษะวิชาชีพดังกล่าว

ตามรายงานของ BusinessWire ภูมิภาคเอเชียแปซิฟิคจะเป็นตลาดที่เติบโตสูงที่สุดที่ CAGR ในช่วยเดียวกัน ทั้งนี้เพราะจำนวนผู้ให้บริการโลจิสติกส์จำนวนมาก มีการแข่งขันที่เข้มข้นซึ่งส่วนหนึ่งนั้นมาจากอุปสงค์จากกลุ่มธุรกิจ outsource นั่นเอง การเติบโตดังกล่าวนี้ได้ดึงดูดให้ผู้เล่นหน้าใหม่ที่ไม่มีโครงสร้างพื้นฐานเป็นของตัวเองเขช้ามาร่วมเล่นด้วย ส่วนผู้เล่นหน้าเดิมนั้นเน้นการเข้าครอบครองขยายส่วนแบ่งการตลาสดเป็นหลัก โดยรวมแล้วภูมิภาคที่ขับเคลื่อนการเติบโตของตลาดนี้คือ เอเชียแฟซิฟิค อเมริกาเหนือ และยุโรปตามลำดับ

Projected market size of the autonomous last-mile delivery worldwide from 2019-2030 (billion US dollars)

ในขณะที่ปริมาณพัสดุสินค้ามากขึ้น ผู้ให้บริการขนส่งก็ต้องรับมือกับจุดส่งสินค้าและจุดพักสินค้ามากขึ้นไปด้วย อีกทั้งความหลากหลายของขนาดและรูปทรงของพัสดุตลอดจนลักษณะทางกายภาพของเส้นทางการนำส่ง จากการสำรวจกรณีที่กำลังเกิดขึ้นในทุกมุมโลก พบว่านวัตกรรมได้เกิดขึ้นแล้วเพื่อรับมือกับ last-mile delivery

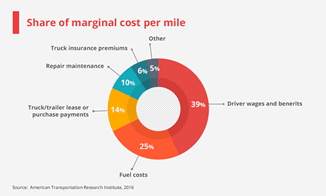

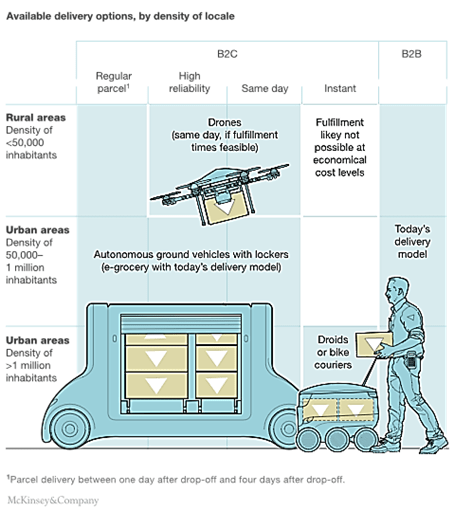

รถบรรทุกขับเคลื่อนด้วยตัวเอง ณ ปัจจุบัน ได้มีการทดสอบ รถบรรทุกไร้คนขับระยะทางไกล รถตู้ หรือรถบรรทุกเชิงพาณิชย์ในรูปแบบอื่นๆ อยู่ทั่วโลก หลายกรณีที่มีการทดสอบบนถนนทางหลวง ประโยชน์ทางเศรษฐกิจของรถบรรทุกขับเคลื่อนด้วยตัวเองนี้มีมหาศาล รวมถึงการลดต้นทุนในการจ้างคนขับ และความสามารถในการให้บริการวันละ 24 ชั่วโมงต่อวัน ทั้งนี้เพราะได้ปลดล็อคข้อจำกัดของผู้ขับขี่ที่เป็นมนุษย์ซึ่งถูกกำหนดจำนวนชั่วโมงการทำงานขับขี่ต่อวัน

รถยนต์ขับเคลื่อนอัตโนมัติส่วนบุคคล บริษัท Nuro ซึ่งเป็นสตาร์ทอัพยานพาหนะขับเคลื่อนอันโนมัติที่โฟกัสการขนส่งสินค้าและบริการช่วง last-mile delivery ได้รวมทีมกับ Kroger เพื่อส่งสินค้าอุปโภคบริโภคด้วยรถยนต์ไร้คนขับได้ทำร่องไป 2 เส้นทาง เส้นทางแรกวิ่งให้บริการตั้งแต่ สิงหาคม 2018 จนถึง มีนาคม 2019 ให้กับร้านค้าปลีกในเมือง Scottdale รัฐ Arkansas ส่วนอีกเส้นทางหนึ่งได้เริ่มเมื่อ มีนาคม 2019 ให้บริการกับร้านค้าปลีกจำนวน 2 ร้านในเมือง Houston รัฐ Texas สำหรับค่าบริการต่อการส่งสินค้าชำในแต่ละครั้งอยู่ที่ 5.95 เหรียญสหรัฐ ผู้บริโภคสามารถเข้าถึงบริการดังกล่าวนี้ได้โดยผ่านระบบซื้อสินค้าออนไลน์ของ Kroger และผ่านแอปของ Nuro ในแถบชุมชนที่ปรากฏรถยนต์ไร้คนขับอัตโนมัติด้วยพลังงานจากแบตเตอร์รี่

หุ่นยนต์บริการขนส่ง ก็เป็นอีกรูปแบบหนึ่งของยานพาหนะขับเคลื่อนอัตโนมัติเพื่องาน last-mile delivery หุ่นยนต์ประเภทนี้เดินทางบนทางเท้าและบนถนน สามารถขนส่งสินค้าได้หนักถึง 50 ปอนด์ในระยะทาง 30 ไมล์ ด้วยความเร็วที่ไม่มากจนเกินไปซึ่งติดตามด้วยระบบ GPS และกล้องที่มาพร้อมระบบเซ็นเซอร์วิสัยทัศน์ 360 องศา ที่มีหน้าที่หนักเพื่อการนำทาง อย่างไรก็ดีหุ่นยนต์เหล่านี้ยังจำเป็นต้องมีมนุษย์คอยดูแลอยู่ห่างๆ

บริการด้วยหุ่นยนต์ลักษณะนี้ยังมีปัญหาอยู่บ้างในเขตชุมชนเมืองโดยเฉพาะในเรื่องของการสร้างกฎระเบียบให้กับการทำงานของหุ่นยนต์ในลักษณะนี้สร้างความสับสนปั่นป่วนและคับคั่งให้กับทางเดินทาง ช่วงปลายปี 2017 ในเมือง San Francisco ได้เข้มงวดอย่างมากให้บริษัทสตาร์ทอัพทดสอบหุ่นยนต์ได้แต่ต้องไม่รบกวนชุมชน ในพื้นที่เมืองที่มีประชนชนอาศัยอยู่น้อย

โดรน การขนส่งด้วยโดรนนำมาใช้งานจริงแล้วแต่รันสภาพแวดล้อมที่เงื่อนไขที่จำกัดมาก เป็นตัวเลือกการขนส่งของเพียงไม่กี่ประเทศ เช่น สหราชอาณาจักร ฝรั่งเศส ญี่ปุ่น และจีน การใช้โดรนเพื่อบรรเทาเหตุทางการแพทย์ในท้องถิ่นที่ห่างไกลและทุรกันดานกำลังได้รับความนิยมเพิ่มมากขึ้นเรื่อยๆ บางโรงแรมเริ่มทดลองเสริฟอาหารและเครื่องดื่มให้กับแขกตามห้องพักกันแล้ว และที่โดรนยังไม่ได้นำไปใช้ในหลากหลายอุตสาหกรรมนั้นมีสาเหตุมาจากความล้าช้าในการทดสอบ ซึ่งมีอุปสรรคคือกฎระเบียบ ข้อบังคับ กฎหมาย ทั้งหมดทั้งมวลนี้ล้วนเป็นความท้าทายทั้งสิ้น อย่างไรก็ตาม ต้นทุนที่ลดลง การหลีกเลี่ยงการสัญจรที่ติดขัด ประสิทธิภาพในการใช้พลังงานและมลภาวะที่ลดลง ล้วนเป็นคุณประโยชน์อเนกอนันต์ที่จะทำให้โดรนเข้าไปแทนที่การขนส่งหลายๆ รูปแบบที่เคยเป็นมาอย่างสิ้นเชิง

จักรยานโกดัง ชาวเมือง Portland ในรัฐ Oregon ต่างคุ้นเคยกับกับจักรยาน B-Line บริษัทขนส่งเจ้าจักรยานที่ขับเคลื่อนด้วยแรงทีบ จักรยานโกดังทั้งที่ขับเคลื่อนด้วยไฟฟ้าโดยสมบูรณ์หรือแบบกึ่งสมบูรณ์แบบสามารถรองรับน้ำหนักได้ถึง 750 ปอนด์ ซึ่งเป็นตัวเลือกที่เหมาะมากในการแทนที่รถตู้เพราะไม่ต้องการพื้นที่จอดขนาดใหญ่ ยิ่งกว่านั้นการบรรจุและการบรรทุกยังใช้เวลาน้อยกว่ารถตู้ เคลื่อนที่ว่องไวคล่องแคล่วแม้ในเขตพื้นที่เมืองซึ่งการจราจรคับคั่งที่มีเส้นทางสำหรับจักรยาน ใช้พื้นผิวการจราจรน้อยจึงทำให้เหมาะสำหรับการทำงานในภาวะเหตุการณ์ฉุกเฉินที่อีกด้วย และ UPS ได้เริ่มนำจักรยานโกดังมาใช้แล้วในปี 2016 โดยเป็นจักรยานแบบสามล้อในเมือง Portland และในปี 2019 ทาง UPS ได้สัมปทานทดลองวิ่งบนทางเท้าและเลนจักรยาน ในย่านธุรกิจในเมือง Seattle ซึ่งรวมถึงย่าน Pike Place Market อีกด้วย

TAKE-HOME MESSAGE

อุปสรรคความยากลำบากในงานขนส่ง last-mile delivery ให้เกิดประสทธิภาพทางต้นทุนให้มากที่สุดต่อธุรกิจค้าปลีกนั้นได้สร้างปัญหาให้กับ e-commerce มาตั้งแต่ยุคก่อตั้ง และได้ทำให้ธุรกิจสตาร์ทอัพที่ให้บริการ last-mile delivery ล้มหายตายจากไปเป็นจำนวนมากในยุคสตาร์ทอัพอินเตอร์เน็ตในช่วงท้ายทศวรรษ 1990s และช่วงต้นทศวรรษที่ 2000s ไม่ว่า e-commerce จะเติบโตรวดเร็วเพียงใดหรือมีวิวัฒนาการเป็นอย่างไร อีกทั้งอุบัติการณ์ของสมาร์ทโฟน แอป และการเชื่อมต่อสื่อสารความเร็วสูง แรงโน้มถ่วงเชิงเศรษฐศาสตร์ของปัญหา last-mile delivery ก็จะยังคงไม่เปลี่ยนแปลงไปจากเดิม