Article by: Asst. Prof. Suwan Juntiwasarakij, Ph.D., MEGA Tech Senior Editor

ขณะที่การซื้อสินค้าออนไลน์ได้รับความนิยมอย่างล้นหลาม ผู้บริโภคต่างคาดหวังให้ออเดอร์และตัวสินค้ามาส่งให้เร็วที่สุด คำถามที่ตอบได้ยากที่สุดก็คือ การขนส่งและโลจิสติกส์ในอนาคตจะเตรียมรับมือกับภาวะบีบคั้นนี้อย่างไร ผู้บริโภคในอนาคตไม่ได้ใส่ใจว่าอะไรอยู่เบื้องหลังความพยายามในการบีบเวลาส่งจากไม่กี่วันสู่ไม่กี่ชั่วโมงกี่นาที อีกทั้ง ไม่มัวมาเสียเวลาติดตามตรวจสอบประสานงานเรื่องจุดนัดส่งสินค้า เวลาส่งสินค้า การส่งสินค้ากลับที่วุ่นวาย หรือการเดินทางของสินค้าจากต่างประเทศแบบไมล์ต่อไมล์ ความสะดวกสะบายที่เทคโนโลยีมอบให้ มาพร้อมกับความคาดหวัง ประกอบนวัตกรรมความก้าวหน้าในวงการขนส่งและโลจิสติกส์ ก็จะยิ่งมีความคาดหวังของผู้บริโภคนั้นสูงตามไปด้วย

Mobility Ecosystem

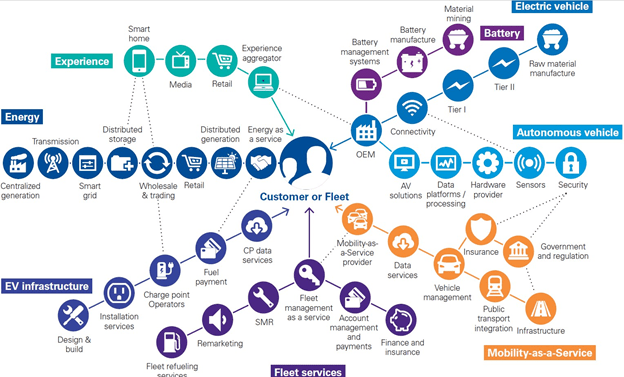

เกิดการเปลี่ยนของระบบนิเวศน์การคมนาคมขนส่งจากเดิมที่มีลักษณะเป็นแนวดิ่งซึ่งแต่ละขั้นตอนกระบวนการไม่ได้เชื่อมต่อกันมาเป็นแบบพึ่งพาอาศัยซึ่งกันและกันตามบทวิเคราะห์ของ KMPG การดำเนินกิจการของอุตสาหกรรมคมนาคมขนส่งส่วนใหญ่ในอดีตมีลักษณะเป็นห่วงโซ่อุปทานเชิงเส้น แต่ตอนนี้ได้เปลี่ยนไปแล้วนั้นตั้งแต่หลายภาคส่วนต่างก็มุ่งที่จะจับฉวยโอกาสที่มาพร้อมกับระบบการคมนาคมขนส่งรูปแบบนี้ใหม่นี้ ผลลัพธ์จึงเกิดเป็นเครือข่ายห่วงโซ่อุปทานที่มีความยึดโยงพึงพาซึ่งกันและกัน คาดว่าจะมีคู่ค้าหน้าใหม่จำนวนมากเข้ามามีส่วนแบ่งในตลาด และยังก่อให้เกิดพันธมิตรทางการและความร่วมมือระหว่างผู้เล่นจำนวนมากเป็นประวัติกาลทั้งนี้ก็เพื่อร่วมกันค้นหาโซลูชันใหม่ๆ นั้นเอง

Source: Mobility 2030 Transforming the Mobility Landscape, KPMG

The Pillars for New Freight Ecosystem

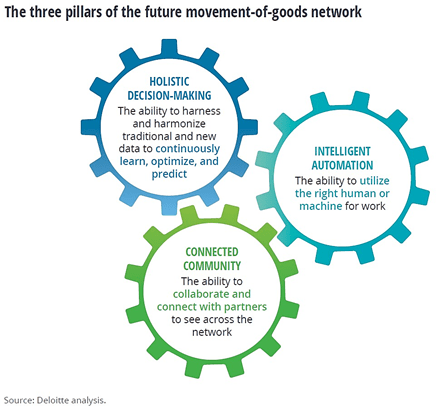

รากฐานของระบบเครือข่ายขนส่งสินค้าระดับโลกยุคต่อไปกำลังเป็นรูปเป็นร่าง เห็นได้จากกิจกรรมที่เกิดขึ้นในระบบนิเวศน์ต่างก็เสริมโครงสร้างของระบบนิเวศน์ในอนาคตอันเป็นเสาหลักของเครือข่ายการขนส่งสินค้าในอนาคตทั้ง 3 ซึ่งได้แก่ (1) การเชื่อมโยงระหว่างชุมชนขนส่ง พาร์ทเนอร์ทางธุรกิจสามารถติดต่อประสานงานและร่วมมือกันไม่ว่าจะอยู่ส่วนใดเครือข่ายที่ (2) การตัดสินใจแบบ่ครบถ้วนบริบูรณ์ โดยเก็บเกี่ยวใช้สอยข้อมูลทั้งรูปแบบดั้งเดิมและรูปแบบใหม่จากทุกทั่วสารทิศในเครือข่ายเพื่อเรียนรู้อันนำไปสู่การพยากรณ์อย่างถูกต้อง และ (3) ระบบอัตโนมัติอัจฉริยะซึ่งมีขีดความสามารถในการแบ่งและแจกจ่ายงานให้กับแรงงานมนุษย์หรือเครื่องจักรที่เป็นระบบงานอัตโนมัติแบบดิจิทัลด้วยสัดส่วนที่เหมาะสม

ด้วยข้อจำกัดทางด้านโครงสร้างพื้นฐานทางกายภาพ โครงสร้างและกระบวนการดิจิทัลแบบใหม่นี้จำเป็นต้องมีกำลังอัตราผลผลิตที่มากขึ้น ลดแรงเสียดทาน และปรับปรุงด้านความโปร่งและการประสานงาน Deloitte ได้กล่าวถึงเสาหลักทั้งสามที่กำลังเป็นรูปเป็นร่างในระบบนิเวศน์การขนส่งสินค้า ดังนี้ เสาแรกคือการขับเคลื่อนเพื่อให้เกิดความโปร่งใส่จากต้นน้ำสู่ปลายน้ำ เสาที่สองคือการขับเคลื่อนให้เกิดความคล่องตัวโดยอาศัยการตัดสินใจที่อยู่บนข้อมูลข้อเท็จจริงจากทุกภาคส่วน และเสารที่สามคือการที่ตัวเครือข่ายทำงานได้โดยไม่ต้องมีมนุษย์เข้าไปแทรกแซง ซึ่งโอกาสทางธุรกิจการค้าที่เกิดขึ้นก็มีที่มาที่หนีไม่พ้นจากเสาร์หลักทั้งสามนี้เอง

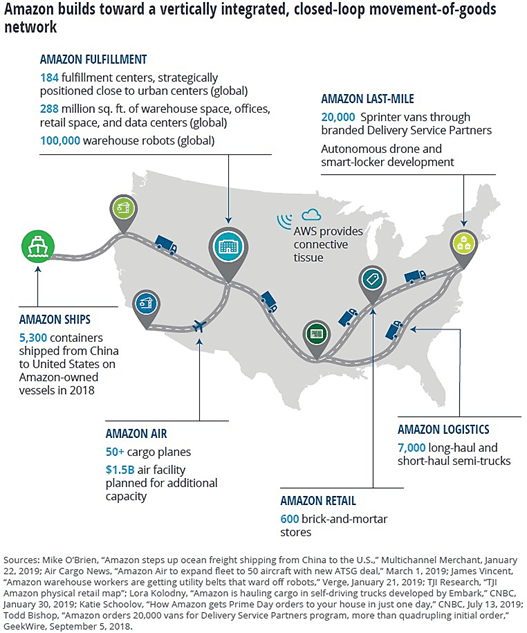

Amazon’s Implementation of Connected Community

เครือข่ายชุมชนของ Amazon เป็นอีกตัวอย่างหนึ่งที่เกิดจากการประยุกต์ใช้งานหลักการที่ถอดออกมาจากเสาหลักแรก โดย Amazon สร้างโครงสร้างพื้นฐานจากต้นน้ำสู่ปลายน้ำ ที่นอกจากรองรับและตอบโจทย์ทางธุรกิจแล้วยังนำเสนอคุณค่าที่เกิดความคาดหวังอีกด้วย อย่างไรก็ตามการทำงานแบบดังเดิมก็จะกลายเป็นตัวถ่วงซึ่งจะหักล้างสิ่งที่ได้รับจากระบบงานใหม่ การลงทุนและนวัตกรรมจึงเป็นแกนกลางของเสาหลักระบบนิเวศน์คมนาคมขนส่งแบบใหม่

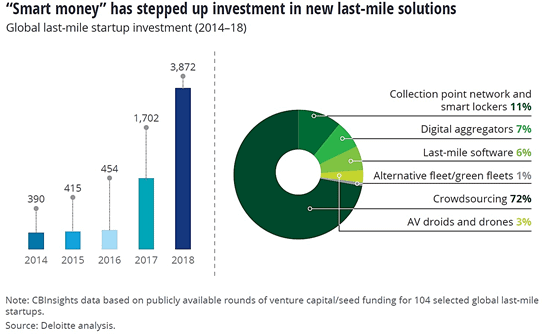

Completing in the Future of the Last Mile

การวิเคราะห์จาก Deloitte ได้ชี้ให้เห็นว่าการตัดสินที่ตั้งอยู่ฐานข้อมูลข้อเท็จจริงจะเป็นฟันเฟืองที่สำคัญต่อความสำเร็จในการขนส่งระยะสุดท้าย (Last-Mile) ผู้ประกอบการทั้งสตาร์ทอัพหน้าใหม่และหน้าเดิมกลุ่มหนึ่งกำลังแข่งขันสร้างโซลูชั่นการขนส่งระยะสุดท้ายในเส้นทางเดินสินค้าที่ท้าทายมากที่สุด หนาแน่นมากที่สุด และมีค่าใช้จ่ายสูงที่สุด ก้อนการลงทุนขนาดมหึมาถูกสูบฉีดไปที่การแก้ปัญหาให้ลูกค้าด้านความเร็วและด้านปริมาณ เม็ดเงินจำนวนมหาศาลอัดฉีดเข้าไปในบริษัทสตาร์อัพที่โฟกัสไปยังนวัตกรรมการขนส่งระยะสุดท้าย ในปี 2014 การลงทุนในจำนวนนี้มีมูลเป็น 390 ล้านเหรียญสหรัฐ ได้พุ่งปะทุไปถึง 3,900 ล้านเหรียญสหรัฐในปี 2018 จากลักษณะการอัดฉีดเม็ดเงินการลงทุน ก็เดาได้ไม่ยากว่าจะเกิดผลลัพธ์การเปลี่ยนแปลงในระยะใกล้และในระยะยาวก็คือความสะดวกสบายและยืดหยุดในการขนส่งระยะสุดท้ายแก่ผู้บริโภคอย่างถล่มทลาย ในขณะที่แนวโน้นทิศทางการลงทุนจะเป็นแบบ crowdsourcing แต่นักลงทุนก็หวังที่จะได้เห็นการผสมผสานเครือข่ายสถานรีรับสินค้า ระบบสมาร์ทล็อกเกอร์ ฝูงยานพาหนะขนส่งที่เชื่อมต่อกัน หุ่นยนต์และโดรนขนส่งแบบไร้มนุษย์ควบคุม และการคำนึงถึงผลกระทบที่มีต่อสภาพแวดล้อมในระหว่างการขนส่งด้วยยานยนต์เพื่อตอบโจทย์ใหม่ของผู้บริโภค

บทวิเคราะห์จาก Deloitte ได้กล่าวว่าพัฒนาการในตลาดการขนส่งระยะสุดท้ายนี้ส่งสัญญาณที่สำคัญและคำถามจำนวนมากมายต่อผู้ให้บริการและผู้ค้าปลีกโลจิสติกส์แบบดั้งเดิม เมื่อพิจารณาถึงศักยภาพขุมพลังในการกระจายสินค้าและความรวดเร็วที่เป็นผลจากการผสมรวมช่องทางขนส่งแบบใหม่ต่างๆ เข้าด้วยกัน ศึกการแย่งชิงลูกค้าจะเกิดขึ้นไม่เฉพาะในสนามการขนส่งระยะสุดท้าย ผู้ให้บริการยังแย่งขันกันเสนอบริการที่ดีที่สุดในระยะ 1,000 ฟุต เมื่อเป็นเช่นนี้แล้วผู้ให้บริการโลจิสติกส์ที่ลงทุนเป็นจำนวนมากไปกับเทคโนโลยีการขนส่งระยะสุดท้ายแบบดั้งเดิมประคองตัวอย่างไรเพื่อให้อยู่รอดได้ในอนาคต พวกเขาจะสามารถยกระดับตัวเองด้วยการรวมตัว เป็นพันธมิตรเพื่อให้เกิดนวัตกรรมเพื่อผลักดันกิจการให้อยู่รอดมีกำไรในสนามแข่งการขนส่งระยะสุดท้ายในระดับโลกได้อย่างไร หรือว่าจะต้องผู้สัมพันธ์กับองค์กรท้องถิ่นที่มีโครงสร้างพื้นฐานการขนส่งและกฎระเบียบเป็นของตัวเองให้สำเร็จได้อย่างไร

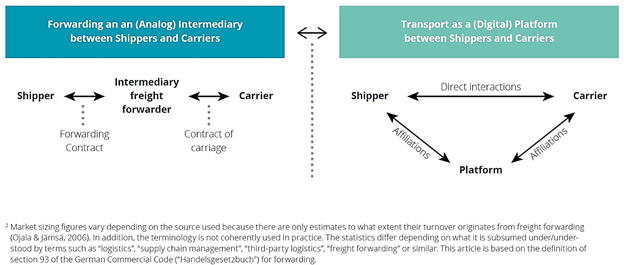

Freight Forwarding Platform

การกำจัดตัวกลางมีผลกระทบอย่างยิ่งต่ออุตสาหกรรมการขนส่งสินค้า ด้วยในช่วงไม่กี่ปีที่ผ่านมานี้ ผู้เล่นในตลาดจำนวนมากต่างก็ตระหนักถึงศักยภาพของแนวคิดการสร้างแพลตฟอร์ม บทวิเคราะห์ของ McKinsey พยากรณ์ว่าผู้ให้บริการเป็นตัวกลางขนส่งสินค้ากำลังจะสูญพันธ์ในอนาคตเนื่องมาจากธุรกิจห้างร้านต่างก็พยายามที่จะพึ่งพาตัวเองมากขึ้น เป็นไปได้สูงที่การเชื่อมต่อในรูปแบบดิจิทัลจะลดบทบาทของผู้ให้บริการตัวกลางขนส่งสินค้าซึ่งมีหน้าที่หลักคือการจัดการประสานงานกับหลายภาคส่วนเทคโนโลยีดิจิทัลทำให้ผู้ส่งสินค้าประสานงานโดยตรงกับและผู้ให้บริการส่งสินค้า ซึ่งจะตอบโจทย์ทางเศรษฐศาสตร์หากแนวคิดแพลตฟอร์มนี้ได้เติบโตเพียงพอจนก่อให้เกิดผลกระทบในระดับมวลวิกฤต ดังนั้น ผู้ที่ให้บริการเป็นตัวกลางการขนส่งกำลังถูกคุกคามจากความพยายามที่จะกำจัดตัวกลางคนส่งออกไป ทั้งนี้ ยังถูกมองอีกด้วยว่าตัวกลางการขนส่งนั้นนอกจากโบราณแล้วยังไม่มีความน่าเชื่อถือ งานของการให้บริการเป็นตัวกลางการขนส่งที่เป็นอยู่ในปัจจุบันและแบบจำลองแพลตฟอร์มที่ทำให้ผู้ส่งสินค้าและผู้ให้บริการส่งสินค้าติดต่อประสานงานกันได้โดยตรงได้ถูกเปรียบเชิงกระบวนทัศน์ดังภาพที่ได้นำเสนอ

Source: Digitization in Freight Forwarding, Deloitte

What to Watch

การมาเยือนของการแปลงรูปทางดิจิทัลนี้ สร้างความชัดเจนที่ว่าบริษัทที่มีลักษณะกิจกรรมทางธุรกิจแบบแพลตฟอร์มคือผู้สร้างความสั่นสะเทือนที่แท้จริง แพลตฟอร์มดิจิทัลได้กำจัดตัวกลางการขนส่งออกไปจากหลายต่อหลายอุตสาหกรรมในชั่วพริบตา โดยเฉพาะอย่างยิ่งในอุตสาหกรรมคมนาคมขนส่ง อันเป็นอุตสาหกรรมที่ผู้เล่นต่างก็จับจ้องหาโอกาสที่เข้ามาเข้าเขย่าตลาดที่มีมูลค่าหลายพันล้านเหรียญสหรัฐ ผู้ให้บริการตัวกลางขนส่งสินค้าถูกมองว่าเป็นเรื่องที่ซ้ำซ้อนและไม่จำเป็นเพราะว่าผู้ส่งสินค้าและผู้ให้บริการส่งสินค้าสามารถติดต่อประสานงานกันโดยตรงโดยผ่านโมเดลแพลตฟอร์ม อย่างไรก็ดีถึงแม้ว่าแพลตฟอร์มตัวปลอมจะพยายามมากเท่าไหร่ก็ตาม ก็ไม่สามารถสร้างความเป็นเปลี่ยนให้ปรากฎเป็นผลกระทบระดับเปลี่ยนเกมได้ และนั่นยิ่งทำให้ตลาดนี้มีลักษณะกระจายตัวมากขึ้นกว่าเดิม

Source: Digitization in Freight Forwarding, Deloitte