Article by: Asst. Prof. Suwan Juntiwasarakij, Ph.D., MEGA Tech Senior Editor

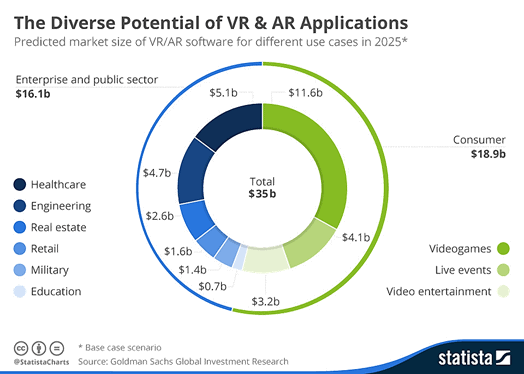

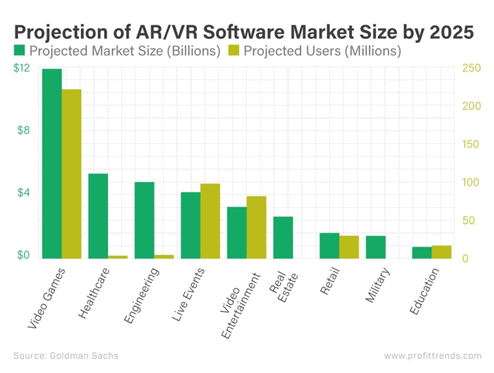

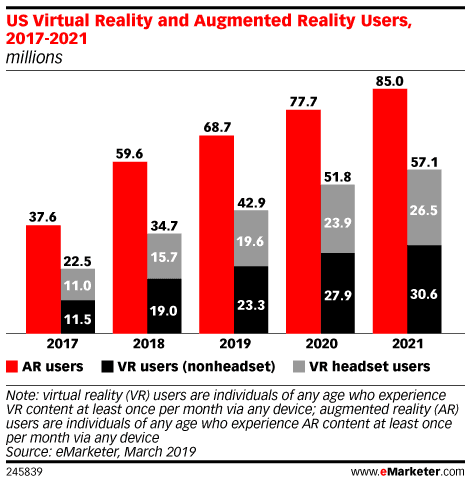

Amidst the hype of virtual and augmented reality, a degree of uncertainty about the t is still: what will it be actually used for. According to Goldman Sachs, the forecast of the industry is expected to reach USD80 billion with 445 million users a year by 2025, USD35 billion in software and USD45 billion in hardware, and the potential of technologies is wildly diverse beyond consumer space. Almost half the industry’s revenue will be generated in the enterprise and public sector in which healthcare and engineering are among the most promising industries.

Source: Augment, IDC Research, Goldman Sachs

Source: Augment, IDC Research, Goldman Sachs

Industrial Applications

Whereas ABI Research estimates the AR/VR market size at USD100 billion by 2020, the projection suggested by Digital Capital is at USD120 billion by the same year. AR and VR have applications in a wide range of industries, though video games and social media have taken the most prominent roles to date. For example, when the social media app Snapchat first burst onto the scene, its initial selling point was its unique photo and video filters that incorporated AR.

After failed attempts to acquire Snapchat in 2013 and 2016, Facebook has since replicated those features and ramped up its own AR content across its apps. Facebook, however, didn’t stop there: it required Oculus VR, the developer of the Oculus Rift VR headset, for USD2 billion. At the end of 2018, Facebook released “Portal” which is the company’s first self-branded smart camera device for video chat, incorporating smart camera device for video chat.

Source: Oculus

Source: Facebook

A few months ago, Facebook released the Oculus Quest, an all-in-one gaming headset, and Mark Zuckerberg’s publicized goal to get 1 billion users. The potential for AR and VR, however, extends far beyond the scope of social media and gaming. In healthcare arena, AR headsets have been extensively studied and developed as a tool to assist surgeons with imaging data and patient information in their fields. This is aimed at minimizing medical errors.

Technology and Business Development

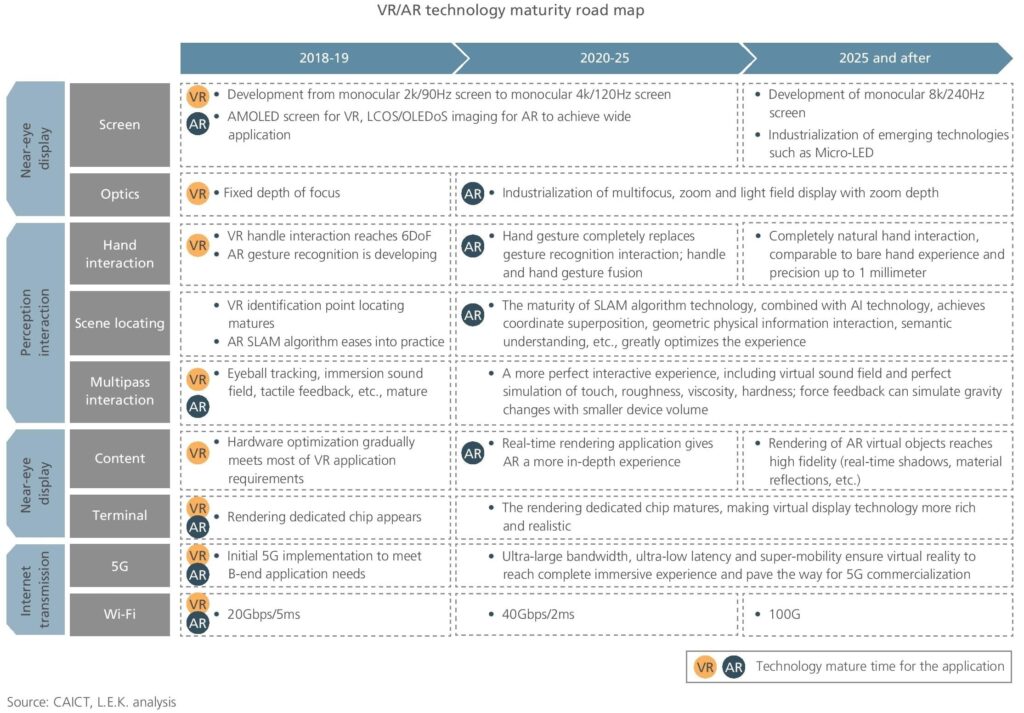

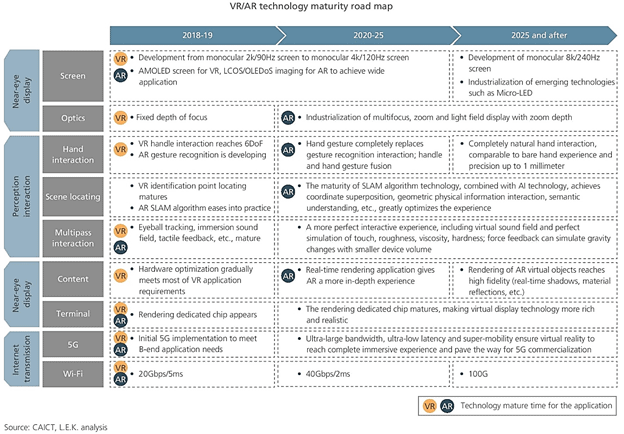

Certain virtual reality component technologies – near-eye display, rendering process, etc. – have been well-developed with clear R&D paths. The maturity of sensing technology and the interactive sensing experience has greatly enriched VR use cases. According to L.E.K. Research, VR/AR technology has made progress on multichannel interaction and network transmission. However, the technology is more complicated with simultaneous localization and mapping (SLAM) algorithms and relevant peripherals and optical displays, therefore the maturity of the technology is not reaching maturity in the near future.

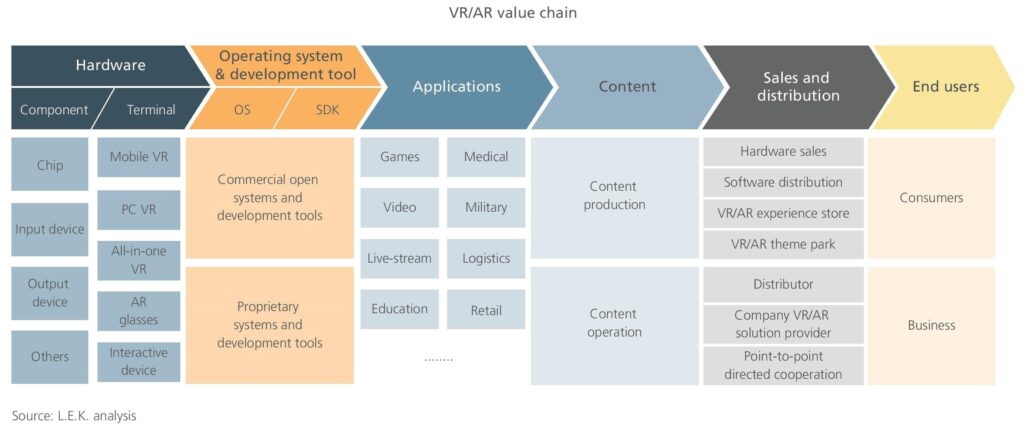

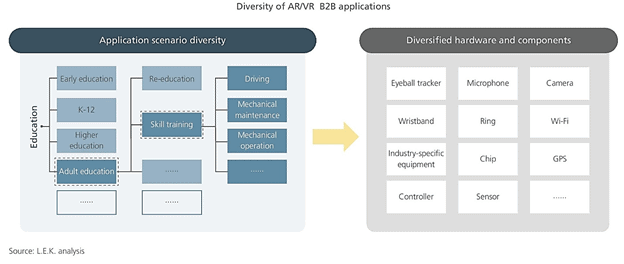

Certain leading technology companies, such as Google, Microsoft, Baidu, Alibaba, and Tencent, have led in investing in B2C models. The VR/AR value chain is a diverse ecosystem that begins with hardware and moves through operating systems and development tools to applications, content, sales and distribution. The consumer market represents greater opportunities. These leading technology firms will likely dominate the consumer market through defining and standardizing the application architecture of VR/AR, and by customizing software services and solutions.

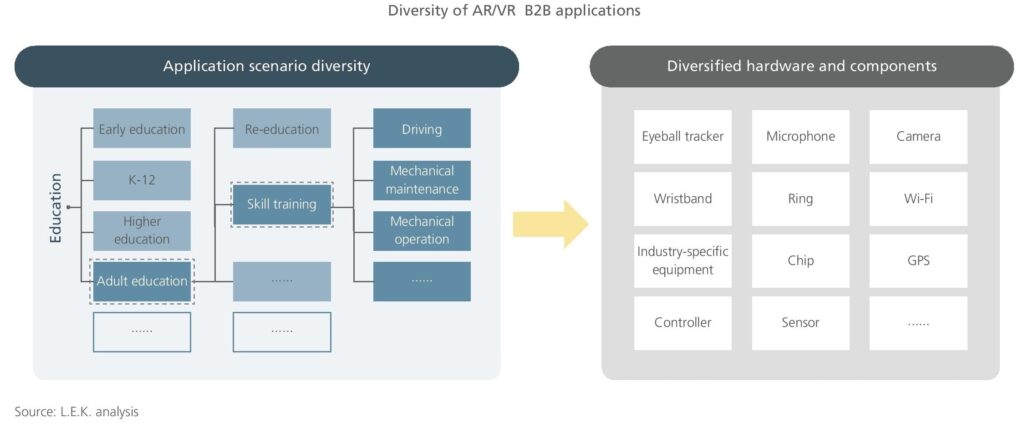

On an example of AR’s application in industries, the method for steel plate inspection and grading differs depending on downstream application. Though experienced workers are able to perform visual grading, it is rather time-consuming and labor-intensive. AR solution companies can collect steel plate grading rules through AI learning and computer vision and embed this rule base into software products. This can create a high technical barrier to additional market entrants.

All in all, development of the AR/VR industry is still in the initial stage. The technology’s application in many industries and fields is still in the concept stage. The business model and profitability also need to be verified. Blindly carrying out cross-industry expansion not only is unconducive to its own technology and product capabilities, but also has a high opportunity cost.