สิงคโปร์ ในฐานะประเทศที่มีเศรษฐกิจก้าวหน้าที่สุดในเอเชียตะวันออกเฉียงใต้ ได้กลายเป็นผู้นำในภูมิภาคในอุตสาหกรรมการบินและอวกาศที่มีเทคโนโลยีขั้นสูงอย่างไม่ต้องสงสัย ประเทศนี้เป็นที่ตั้งของบริษัทด้านอวกาศกว่า 130 แห่ง ซึ่งเกี่ยวข้องกับหลากหลายภาคส่วน รวมถึงการผลิตส่วนประกอบสำคัญ เช่น ชิ้นส่วนเครื่องยนต์และระบบอิเล็กทรอนิกส์การบิน นอกจากนี้ สิงคโปร์ยังเป็นผู้ให้บริการโซลูชั่น MRO แบบครบวงจรชั้นนำของเอเชีย

โดยมีสัดส่วนถึง 10% ของผลผลิต MRO ทั่วโลก MRO ครอบคลุมงานบำรุงรักษาทั้งหมดที่จำเป็นต่อความปลอดภัยและความสมควรเดินอากาศของยานพาหนะขนส่งทางอากาศ ด้วยตลาด MRO ทั่วโลกที่คาดว่าจะเติบโตมากกว่า 33% ระหว่างปี 2023 ถึง 2033 สิงคโปร์จึงอยู่ในสถานะที่ดีที่จะคว้าส่วนแบ่งที่สำคัญของการเติบโตนี้

โครงสร้างพื้นฐานที่ยอดเยี่ยม ความเชี่ยวชาญด้านวิศวกรรม และความพร้อมของบุคลากรที่มีทักษะ กำลังดึงดูดการลงทุนครั้งใหญ่จากบริษัทชั้นนำระดับโลกด้านอวกาศ บริษัทต่างๆ เช่น Pratt & Whitney, Rolls-Royce, Thales, Airbus และ GE Aerospace ได้ให้คำมั่นสัญญาว่าจะลงทุนกว่า 750 ล้านดอลลาร์สหรัฐ ในโครงการมากกว่า 10 โครงการในช่วงสามถึงห้าปีข้างหน้า

การลงทุนนี้คาดว่าจะสร้างงานใหม่กว่า 2,500 ตำแหน่งในอุตสาหกรรมในช่วงเวลาเดียวกันเพื่อรองรับแผนการขยายธุรกิจ

มาเลเซีย ซึ่งปัจจุบันมีอุตสาหกรรมการบินและอวกาศที่ใหญ่เป็นอันดับสองในเอเชียตะวันออกเฉียงใต้ มีแผนการที่ทะเยอทะยานที่จะก้าวขึ้นเป็นผู้นำด้านการบินและอวกาศในภูมิภาค และเป็นส่วนสำคัญของตลาดโลก แผนของรัฐบาลมาเลเซียมีเป้าหมายที่จะสร้างรายได้รวม 55.2 พันล้านริงกิต และสร้างงานที่มีรายได้สูงกว่า 32,000 ตำแหน่ง ปัจจุบันประเทศนี้เป็นที่ตั้งของบริษัทด้านอากาศยานมากกว่า 200 แห่ง ทั้งบริษัทต่างชาติและบริษัทในประเทศ

ห่วงโซ่อุปทานที่แข็งแกร่งและมีการแข่งขันสูง ซึ่งรวมถึงวิศวกรรมที่มีความแม่นยำ การผลิตขั้นสูง และเทคโนโลยีที่ทันสมัย เป็นรากฐานของภาคส่วนนี้

ตัวอย่างเช่น Airbus ยกย่องให้บริษัทมาเลเซีย เช่น CTRM และ SME Aerospace ให้เป็นซัพพลายเออร์ชั้นนำ รัฐบาลกำลังพยายามดึงดูดการลงทุนโดยตรงจากต่างประเทศ (FDI) โดยการดำเนินมาตรการจูงใจต่างๆ สำหรับนักลงทุน ซึ่งรวมถึงการลดหย่อนภาษี เงินช่วยเหลือ และกระบวนการกำกับดูแลที่คล่องตัว

ประเทศไทยก็มีเป้าหมายที่จะพัฒนาอุตสาหกรรมการบินและอวกาศ โดยใช้ประโยชน์จากพื้นฐานอุตสาหกรรมการผลิตยานยนต์ที่แข็งแกร่งของตนเอง คณะกรรมการส่งเสริมการลงทุนของรัฐบาลกำลังเน้นเป็นพิเศษในการพัฒนาประเทศไทยให้เป็นผู้จัดหาชิ้นส่วนเครื่องบินที่สำคัญ

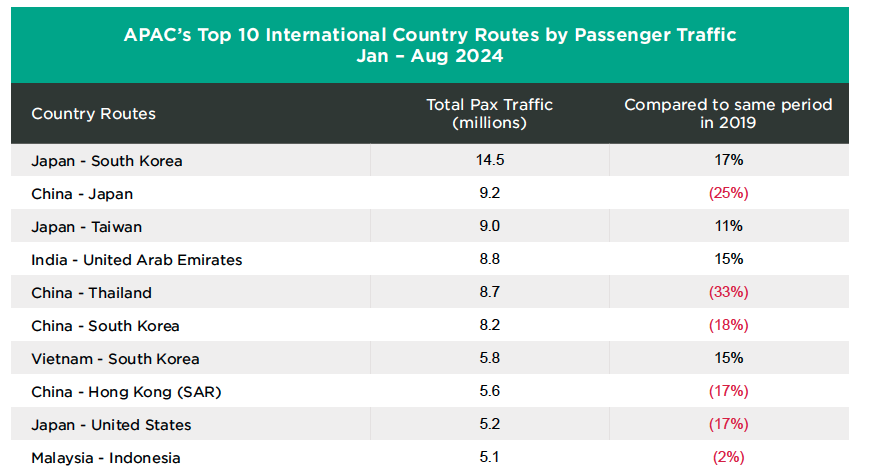

การเติบโตของการขนส่งผู้โดยสารทางอากาศในประเทศไทย และศักยภาพในการเติบโตต่อไปในอนาคต ทำให้ประเทศไทยเป็นจุดหมายปลายทางที่น่าสนใจสำหรับธุรกิจบำรุงรักษาและผลิตเครื่องบิน ตามข้อมูลของ Tractus บริษัทที่ปรึกษาด้านกลยุทธ์ธุรกิจและการจัดการ

การดำเนินงาน Airports Council International คาดการณ์ว่าประเทศไทยจะก้าวขึ้นเป็นอันดับที่ 9 ของโลกในด้านการขนส่งผู้โดยสารทางอากาศภายในปี 2040

ซึ่งแสดงให้เห็นถึงโอกาสที่สำคัญสำหรับผู้ให้บริการ MRO ในท้องถิ่น ความต้องการบริการ MRO ในประเทศไทยคาดว่าจะเพิ่มขึ้นเป็น 2.95 พันล้านดอลลาร์สหรัฐภายในปี 2037 (CAGR ประมาณ 5.4%)

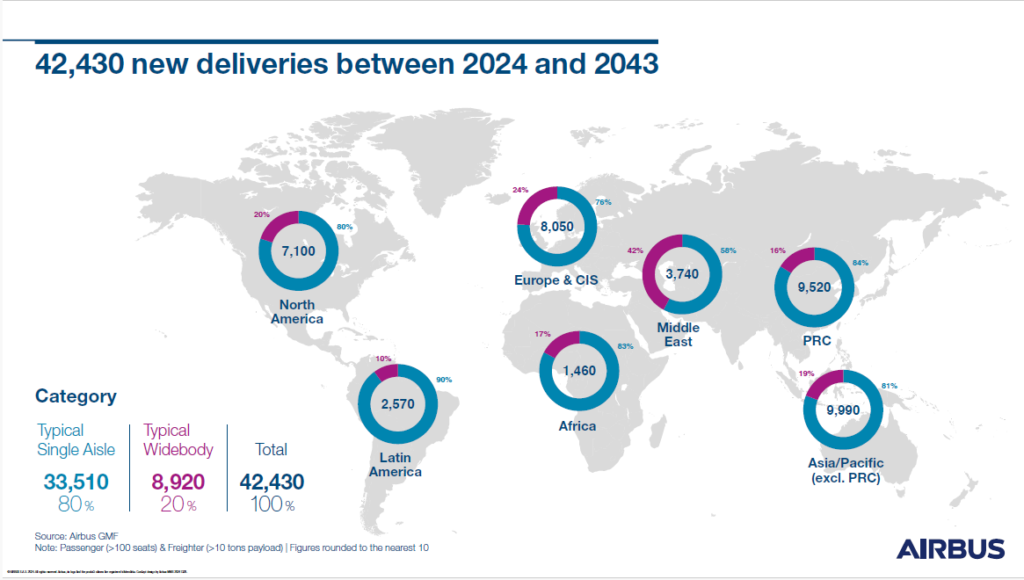

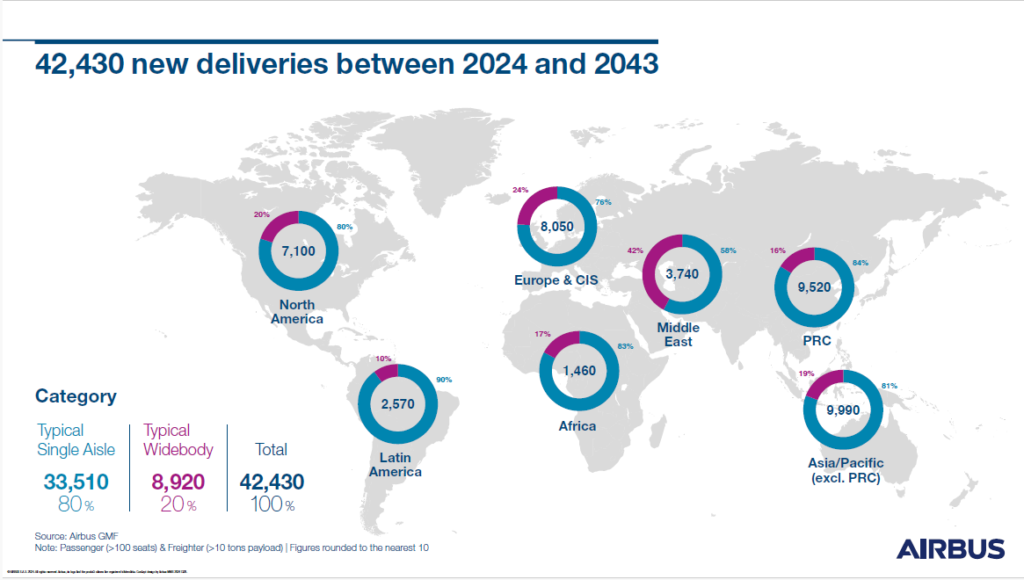

โดยความต้องการเครื่องบินในประเทศไทยจะเพิ่มขึ้นจาก 314 เป็น 811 ลำ ตามข้อมูลของ Tractus ประเทศไทยควรจะใช้ประโยชน์จากความเชี่ยวชาญที่สั่งสมมาในภาคยานยนต์ ซึ่งได้ส่งเสริมการพัฒนาโครงสร้างพื้นฐานด้านโลจิสติกส์ขั้นสูง และเครือข่ายที่หลากหลายของผู้จำหน่ายผลิตภัณฑ์อุตสาหกรรม ชิ้นส่วน อุปกรณ์ และบริการที่มีประสบการณ์

มหาวิทยาลัยในประเทศไทยยังพิสูจน์ให้เห็นถึงความสามารถในการผลิตบัณฑิตด้านวิศวกรรมและบุคลากรที่มีทักษะอื่นๆ การพัฒนาอุตสาหกรรมการบินยังเป็นส่วนหนึ่งของโครงการพัฒนาระเบียงเศรษฐกิจพิเศษภาคตะวันออกของประเทศไทย สนามบินอู่ตะเภา ซึ่งเป็นสนามบินหลักทางชายฝั่งตะวันออกของประเทศไทย มีโครงการที่จะขยายและกลายเป็นศูนย์กลาง MRO สำหรับอุตสาหกรรมที่เกี่ยวข้องกับการบิน โดยมีเป้าหมายการลงทุน 7 พันล้านดอลลาร์สหรัฐ

ในอดีต อินโดนีเซียเคยมีเป้าหมายที่จะเป็นผู้เล่นหลักในอุตสาหกรรมการบินและอวกาศภายใต้ประธานาธิบดีซูฮาร์โต ปัจจุบัน ด้วยวิสัยทัศน์ “อินโดนีเซียทองคำ 2045” ที่เปิดตัวในปี 2022 ประเทศกำลังพยายามที่จะฟื้นฟูวิสัยทัศน์ อีกทั้งยังมีเป้าหมายที่จะผลิตเครื่องบินใบพัดที่มีที่นั่งน้อยกว่า 100 ที่นั่งพร้อมติดตั้งเทคโนโลยีล้ำสมัย

การผลิตโดรนขนส่งสินค้าขนาดใหญ่สองตัน และการก้าวขึ้นเป็นผู้ผลิตเครื่องฝึกบินจำลองชั้นนำ อินโดนีเซียยังตั้งเป้าหมายให้อุตสาหกรรมการบินและอวกาศของตนมีรายได้จากการให้บริการ MRO ประมาณ 2 พันล้านดอลลาร์สหรัฐภายในปี 2045 ข้อได้เปรียบของอินโดนีเซียในการดึงดูด FDI ด้านอวกาศ ได้แก่ ตลาดภายในประเทศขนาดใหญ่และงบประมาณด้านกลาโหมที่เพิ่มขึ้น อย่างไรก็ตาม

เมื่อเทียบกับประเทศต่างๆ เช่น มาเลเซีย สิงคโปร์ และประเทศไทย ประเทศอินโดนีเซียเผชิญกับความท้าทายต่างๆ เช่น โครงสร้างพื้นฐานและการพัฒนาด้านโลจิสติกส์ที่อ่อนแอกว่า อย่างไรก็ตาม ในเดือนมิถุนายน Boeing แสดงความสนใจที่จะร่วมมือกับรัฐบาลอินโดนีเซียและผู้มีส่วนได้ส่วนเสียเพื่อสนับสนุนการพัฒนาอุตสาหกรรม มีรายงานว่า Boeing กำลังทำงานร่วมกับสำนักงานวางแผนพัฒนาแห่งชาติ และกระทรวงต่างๆ รวมถึงเจ้าหน้าที่รัฐบาล หน่วยงานกำกับดูแล และบริษัทต่างๆ

เวียดนามมีศักยภาพที่สำคัญอย่างยิ่งในด้านอวกาศ โดยเป็นตลาดการบินที่เติบโตเร็วที่สุดในเอเชียตะวันออกเฉียงใต้ และเติบโตเร็วเป็นอันดับห้าของโลกในด้านการขนส่งผู้โดยสารและสินค้า ด้วยความต้องการชิ้นส่วนเครื่องบินที่เพิ่มขึ้น

ในขณะที่ผู้ผลิตเครื่องบินชั้นนำระดับโลกกำลังเผชิญกับคำสั่งซื้อที่คั่งค้าง โอกาสจึงเปิดกว้างสำหรับธุรกิจเวียดนามที่จะมีส่วนร่วมในห่วงโซ่อุปทานมากขึ้น ดังที่บทความล่าสุดใน Vietnam Investment Review กล่าวถึง มีความหวังว่าบริษัทชั้นนำด้านอวกาศ เช่น Boeing, Airbus, Dassault Aviation และ Lockheed Martin อาจย้ายฐานการผลิตบางส่วนมายังประเทศนี้

ความท้าทายที่ยิ่งใหญ่ที่สุดที่ธุรกิจเวียดนามเผชิญคือผลิตภัณฑ์ของพวกเขาต้องเป็นไปตามมาตรฐานการบินระดับโลก รวมถึงข้อกำหนดเฉพาะของ Boeing ตามที่ปรึกษาที่อ้างอิงโดย Vietnam Investment Review กล่าว อย่างไรก็ตาม เมื่อพิจารณาจากความสำเร็จของเวียดนามในการขยายไปสู่ภาคการผลิตอื่นๆ Worldbox Business Intelligence เชื่อมั่นว่าประเทศนี้สามารถเอาชนะความท้าทายนี้ได้

Article by: Asst. Prof. Suwan Juntiwasarakij, Ph.D., Senior Editor & MEGA Tech